Custom Portfolio Optimization: Balancing Objectives, Constraints, and Efficiency

The following blog was written by Marshall Alphonso Principal Engineer and Sara Galante, Senior Finance Application Engineer at MathWorks

Watch the full webinar Custom Portfolio Optimization: Balancing Objectives, Constraints, and Efficiency here, download the slides or download the code here.

Portfolio optimization is fundamental to financial modelling. Investors and portfolio managers must balance multiple objectives while considering various constraints, including liquidity, risk exposure, and investment mandates. The recent webinar, Custom Portfolio Optimization: Balancing Objectives, Constraints, and Efficiency, explored these challenges through practical examples and demonstrated how modern tools can improve optimization workflows.

Understanding Portfolio Optimization Challenges

Building an effective portfolio optimization framework requires speed, robustness, and customization. Traditional models, such as Mean-Variance Optimization (MVO), have long served as the foundation, but evolving investment strategies demand more flexibility. As illustrated in the webinar, financial professionals face critical bottlenecks in:

- Defining objective functions: Balancing returns, risk-adjusted performance, and transaction costs.

- Managing constraints: Incorporating investor preferences, liquidity constraints, and tax considerations.

- Optimizer efficiency: Addressing computational bottlenecks and enhancing solver performance.

Selecting the Right Optimization Framework

Different portfolio optimization frameworks offer distinct advantages depending on the investment problem. The webinar highlighted three core frameworks used to accelerate portfolio formulation:

- Risk-Return Models: Traditional approaches like Mean-Variance Optimization (MVO) and Conditional Value at Risk (CVaR).

- Custom Portfolio Models: Flexible, problem-based optimization with user-defined objective functions.

- Constraint-Based Approaches: Optimizations incorporating budget constraints, trading limits, and regulatory requirements.

Three core frameworks guide portfolio formulation, each suited for different investment scenarios.

Experiment Manager: Streamlining Custom Optimization

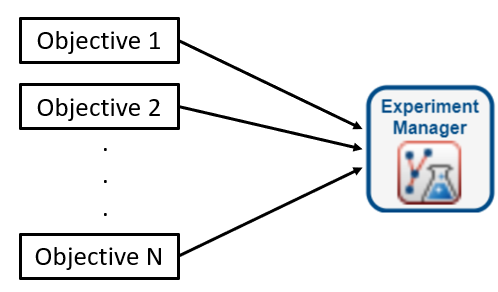

The MathWorks Experiment Manager app simplifies the process of designing and executing portfolio optimization experiments. By allowing users to systematically explore different hyperparameters, it enhances model efficiency and robustness.

Key benefits of Experiment Manager include:

- Automated Parameter Sweeping: Eliminates manual iteration through automated testing of hyperparameter combinations.

- Parallel Computing Support: Enables faster execution of large-scale portfolio optimizations.

- Integrated Data Management: Organizes results in structured tables for easier analysis.

Experiment Manager streamlines the process of testing multiple portfolio configurations.

Analyzing Portfolio Trade-Offs

A crucial insight from the webinar was the impact of different objective functions on portfolio performance. The example demonstrated how prioritizing expected returns increases volatility, while a tracking error approach results in more stable but lower-returning portfolios. The Experiment Manager app facilitated this comparison by efficiently running multiple scenarios.

Trade-offs in portfolio optimization: Higher expected returns come with increased volatility.

Looking Ahead: Robust Optimization for Portfolio Management

Robust optimization techniques are becoming increasingly important as financial markets evolve. The webinar concluded with a discussion on improving model resilience through better constraint handling and computational efficiency.

MathWorks provides a comprehensive suite of optimization tools, including:

- Portfolio Object Framework: Built-in capabilities for risk-return optimization.

- Custom Portfolio Models: Flexible problem-based approaches.

- Advanced Solver Integration: Support for convex and non-convex optimization problems.

Conclusion

Portfolio optimization remains a complex challenge, but tools like MATLAB and the Experiment Manager app enable financial professionals to develop more efficient, customized strategies. Whether managing risk-return trade-offs or implementing advanced constraint-based optimizations, these solutions help quants and portfolio managers build robust and scalable models.

For more insights, watch the full webinar Custom Portfolio Optimization: Balancing Objectives, Constraints, and Efficiency here, or download the slides or download the code here.

Stay tuned for more discussions on portfolio management techniques and optimization tools. For additional resources, explore MATLAB’s finance solutions.

- Category:

- Asset Management,

- New Features

Cleve’s Corner: Cleve Moler on Mathematics and Computing

Cleve’s Corner: Cleve Moler on Mathematics and Computing The MATLAB Blog

The MATLAB Blog Guy on Simulink

Guy on Simulink MATLAB Community

MATLAB Community Artificial Intelligence

Artificial Intelligence Developer Zone

Developer Zone Stuart’s MATLAB Videos

Stuart’s MATLAB Videos Behind the Headlines

Behind the Headlines File Exchange Pick of the Week

File Exchange Pick of the Week Internet of Things

Internet of Things Student Lounge

Student Lounge MATLAB ユーザーコミュニティー

MATLAB ユーザーコミュニティー Startups, Accelerators, & Entrepreneurs

Startups, Accelerators, & Entrepreneurs Autonomous Systems

Autonomous Systems Quantitative Finance

Quantitative Finance MATLAB Graphics and App Building

MATLAB Graphics and App Building Semiconductor Design and Verification

Semiconductor Design and Verification

Comments

To leave a comment, please click here to sign in to your MathWorks Account or create a new one.