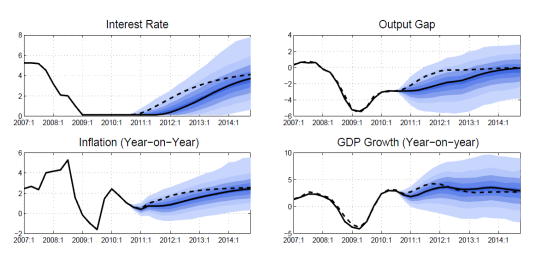

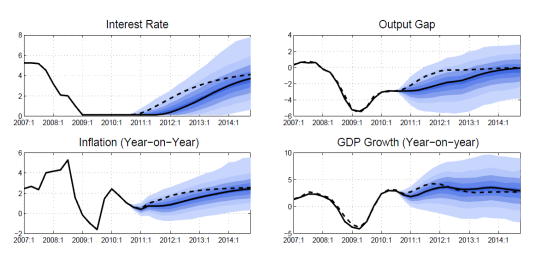

Nonlinear confidence bands help you quantify forecast uncertainty in DSGE models, but they can be slow to compute. At the MathWorks Finance Conference, Kadir Tanyeri (International Monetary Fund)… 続きを読む >>

Nonlinear confidence bands help you quantify forecast uncertainty in DSGE models, but they can be slow to compute. At the MathWorks Finance Conference, Kadir Tanyeri (International Monetary Fund)… 続きを読む >>

Dynamic Stochastic General Equilibrium (DSGE) models are essential tools for policy analysis and forecasting, but estimation runs often exceed 24 hours—particularly for large-scale models or Bayesian… 続きを読む >>

Summary

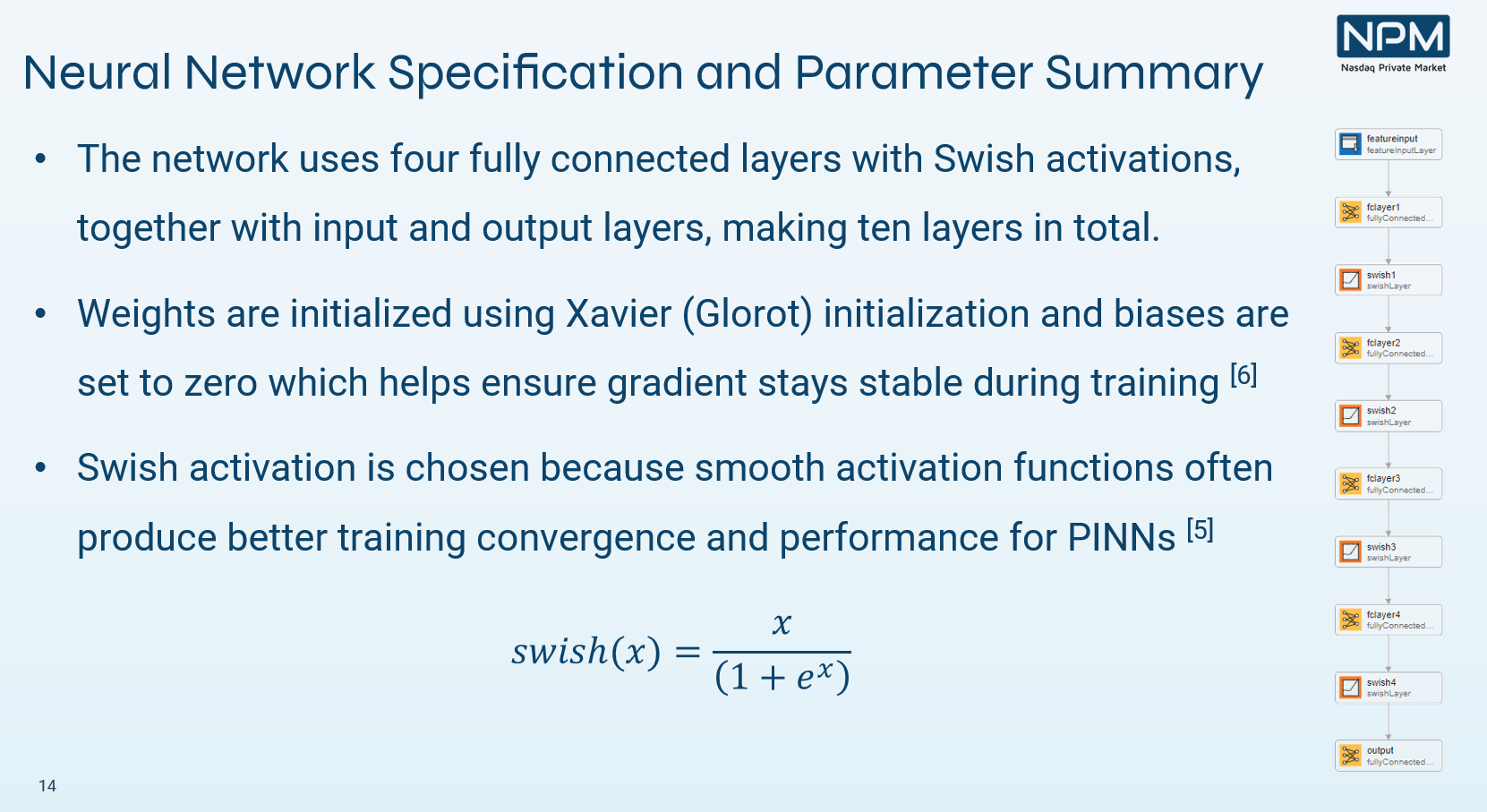

Nasdaq Private Market (NPM) used MATLAB® to prototype and scale physics‑informed neural networks (PINNs) that price Special Purpose Vehicles (SPVs) with embedded carried interest and… 続きを読む >>

The 2025 MathWorks Finance Conference brought together quants, economists, financial modelers and researchers to explore how MATLAB is shaping the future of finance. Across two days, speakers shared… 続きを読む >>

The following post is from Yuchen Dong, Senior Financial Application Engineer at MathWorks.

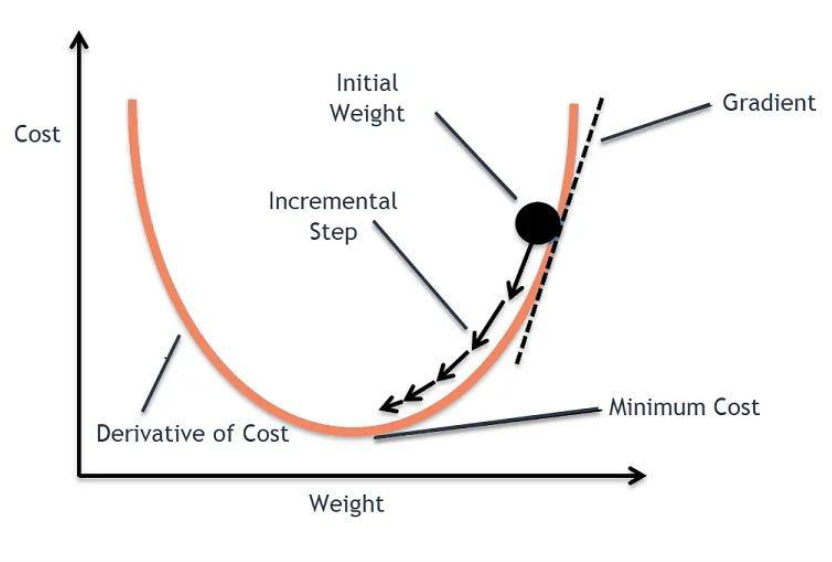

Financial institutions forecast GDP to set capital buffers and plan stress-testing scenarios. Using MATLAB®… 続きを読む >>

The following post is from Yuchen Dong, Senior Financial Application Engineer.

The code presented in this blog can be found here.

This example demonstrates a practical tool for modeling the… 続きを読む >>

The following blog was written by Owen Lloyd , a Penn State graduate who recently join the MathWorks Engineering Development program.

The code used to develop this example can be found on GitHub… 続きを読む >>