MathWorks Finance Conference 2023

It’s my pleasure to give everyone a sneak peek into the upcoming MathWorks Finance 2023 conference, which will be held virtually over 2 days on October 11 and 12.

You will get a chance to hear how industry professionals talk on how MATLAB is having transformative impact on their work with talks that cover topics in asset management, quantum and AI, climate and central banking in interactive sessions. In this blog, l will list some of the key takeaways from the conference, offering a concise overview on what you will expect to see.

View the full agenda and register for the MathWorks Finance Conference 2023 here.

Day 1 (Oct 11) – Speakers include MathWorks, Amundi Convexity Solution, Helaba Invest and Morgan Stanley

Keynote: Transformative Power of MATLAB in Finance

The keynote presentation will highlight MATLAB®’s revolutionary impact on quantitative finance, focusing on four core aspects:

- Advanced Automation

- Democratized Model Development

- AI and Quantum Integration

- ModelOps Transformation

Asset Management Talks:

Multiperiod Goal-Based Wealth Management Using Reinforcement Learning

This session from MathWorks will introduce reinforcement learning as a flexible approach to solving multiperiod asset allocation problems. MATLAB® played a pivotal role in defining portfolio states, modeling reward functions, and simulating portfolios, promising more robust trading and asset allocation strategies.

Development of a Performance Analysis App from Design to Deployment

The Amundi Convexity Solutions team will present a robust performance analysis framework tailored for their unique option-based protective overlays. This framework, which considers dimensions like downside risk protection and drawdown management, challenges conventional performance metrics. MATLAB® App Designer played a central role in creating an application for efficient report generation and customization.

Extending the Scope: From Back-Office Engine to Growing Front-Office Platform

Helaba Invest will showcase their journey in updating their risk management processes by developing an in-house front-office platform using MATLAB products. This platform offers detailed portfolio views and efficient integration between MATLAB Production Server, MATLAB Web App Server, and Microsoft Excel.

AI and Quantum Talks:

Quantum Innovation in Finance: Portfolio Optimization and Monte Carlo Simulation

This session from MathWorks will explore the potential of quantum computing in revolutionizing portfolio management and risk analytics. Quantum algorithms promise to process voluminous financial datasets with unprecedented efficacy, leading to optimal portfolio mixes. Quantum Monte Carlo simulations will also be spotlighted for their potential to turbocharge risk analytics.

Review of AI and Machine Learning Usage in Financial Applications

This presentation from Morgan Stanley will provide an encompassing overview of AI and machine learning techniques in finance. The rapid deployment of these techniques in areas like client outreach, language processing, and data utilization was highlighted. The need for caution and the evolving role of regulators in this domain will also be addressed.

Day 2 (Oct 12): Speakers include Caisse Centrale de Réassurance (CCR), Columbia University, MathWorks, Dynare, European Central Bank, IMF and the Federal Reserve

Climate Finance Talks:

Modeling Climate Change Impact on Insured Losses

The Caisse Centrale de Réassurance (CCR) in France is at the forefront of understanding risk exposure and estimating insured losses from catastrophic events. Using climate simulations provided by Météo-France, combined with their catastrophe models, CCR projects how hazards and insured losses in France will evolve by 2050. Their original methodology, involving constant climate simulations, allows for the estimation of return periods for extreme events and their annual probability of occurrence in a changing climate.

CRISK: Assessing Banks’ Resilience to Climate-Related Risks

Columbia University, along with MathWorks, will present a market-based methodology to evaluate bank resilience to climate-related risks. This methodology, based on work published by economists at the Federal Reserve Bank of New York, introduces CRISK—a metric representing the expected capital shortfall in a climate stress scenario. By examining banks’ stock return sensitivity to climate risk factors, referred to as “climate beta,” this approach offers a robust method for assessing and managing climate-related risks at the financial institution level.

Central Banking talks:

Dynare: Democratizing Macroeconomic Modeling

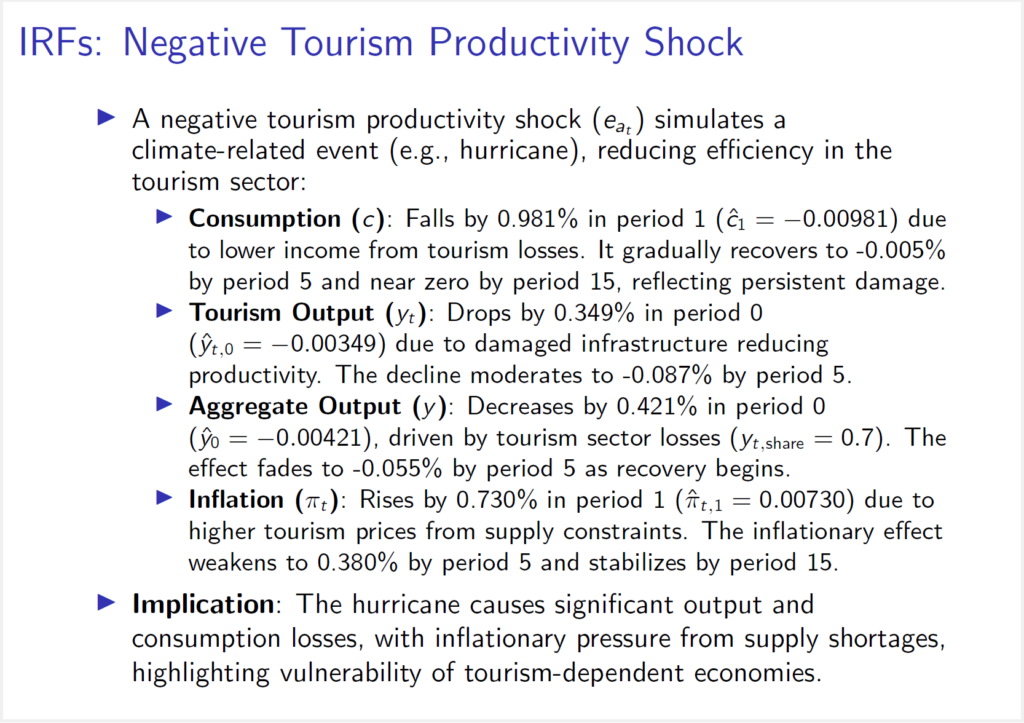

CEPREMAP will talk about Dynare, a powerful macroeconomic modeling tool built on MATLAB®. Dynare offers a user-friendly way to describe and simulate macroeconomic models, making it a crucial tool for policy analysis and economic forecasting. It employs a range of advanced mathematical and computational techniques, including optimization, matrix factorizations, and Bayesian estimation methods. Dynare’s open-source nature has fostered a vibrant community of users, making it a valuable resource in academia and public policy.

BEAR Toolbox for Forecasting and Policy Analysis

The European Central Bank will present on the Bayesian Estimation, Analysis and Regression (BEAR) toolbox, a widely used Bayesian vector autoregression toolbox for forecasting and policy analysis. Built on MATLAB®, this toolbox provides a comprehensive framework for assessing economic relationships. It has found extensive applications in central banks, academia, and finance, making it a vital tool for forecasting and policy analysis.

Nonlinear Confidence Bands in MATLAB

The International Monetary Fund will discuss the importance of computing confidence bands around projections in nonlinear economic models. To address this, he will introduce a structured approach—Latin hypercube sampling—implemented in MATLAB. This technique accelerates convergence and reduces the number of simulations needed to estimate confidence intervals. Additionally, the talk will highlight the use of distributed computing over a cluster of servers to further expedite the process.

Foreign Economic Policy Uncertainty and US Equity Returns

This presentation from the Federal Reserve will delve into the predictive power of foreign economic policy uncertainty (EPU) for US equity returns. By orthogonalizing global EPU with respect to US EPU, it was found that foreign EPU holds significant predictive power for various categories of stock returns. The research also revealed that stocks of firms highly sensitive to foreign EPU, whether positively or negatively, outperform those less sensitive, underscoring the economic significance of this measure in the equity market.

This summary provides a glimpse of the outstanding quality of talks you can expect. Please join me and the dynamic MATLAB Finance user community by registering for the event through the link below.

View the full agenda and register for the MathWorks Finance Conference 2023 here.

评论

要发表评论,请点击 此处 登录到您的 MathWorks 帐户或创建一个新帐户。