The Path to Carbon Neutrality: A Time Series Approach

The following blog was written by Leslie Zhang, a Northeastern graduate who recently joined MathWorks Engineering Development program. This post aims to highlight the collaboration opportunities available to students and Leslie’s journey to joining MathWorks.

Background:

As a young engineer, I always dreamed of contributing to a company that values innovation and fosters collaboration. My journey led me to a place that exceeded my expectations – the MATLAB and Simulink Challenge Projects and the Engineering Development Group at MathWorks.

My education stands at the intersections between Econometrics and Computer Science, and this leads me to explore the interest in deploying data science models to resolve industrial pain points. In February 2023, I got a chance to collaborate with MathWorks through the MATLAB and Simulink Challenge Projects, led by Roberto Valenti. This initiative provides a platform for students to engage in research, explore cutting-edge technologies, and contribute to groundbreaking projects. It was through this project that I had the privilege of collaborating with Yuchen Dong, a Senior Financial Application Engineer at MathWorks. Together, we embarked on a mission to tackle the pressing issue of carbon neutrality using a time series approach.

Our project aimed to develop innovative solutions using machine learning, deep learning, time series analysis, and Monte Carlo simulation, all powered by MATLAB. In comparison with open-source tools like Python and TensorFlow, I choose MATLAB as the primary language because it empowers data model deployment with extensive toolboxes such as Econometrics Toolbox that supports auto code generation. MATLAB also provides specialized tools for displaying and sharing models in standalone applications and web applications, such as MATLAB Compiler and MATLAB Production Server. Our journey culminated in the publication of a conference paper titled “The Path to Carbon Neutrality: A Time Series Approach“, presented at the 2023 SPIE Conference: Machine Learning Chapter in San Diego, California. This Machine Learning conference attracts engineers and scientists to show how data science can release its potential in various industries, from optics manufacturing, physics, to environmental engineering.

The project highlighted the potential of MathWorks’ software in addressing complex challenges and underscored the company’s commitment to sustainability and carbon reduction efforts.

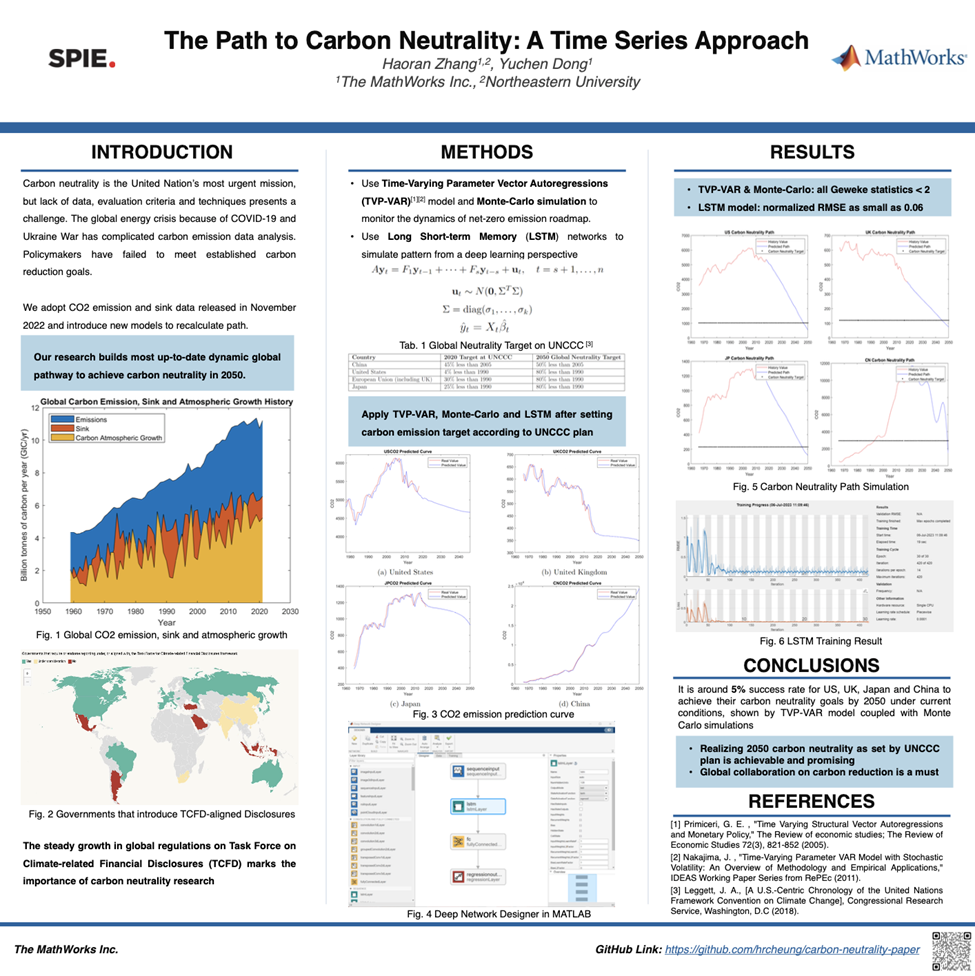

Poster presented at SPIE 2023

Yuchen Dong and Leslie Zhang at SPIE 2023

The project:

This example produced from this project leveraged MATLAB R2023a and according toolboxes to

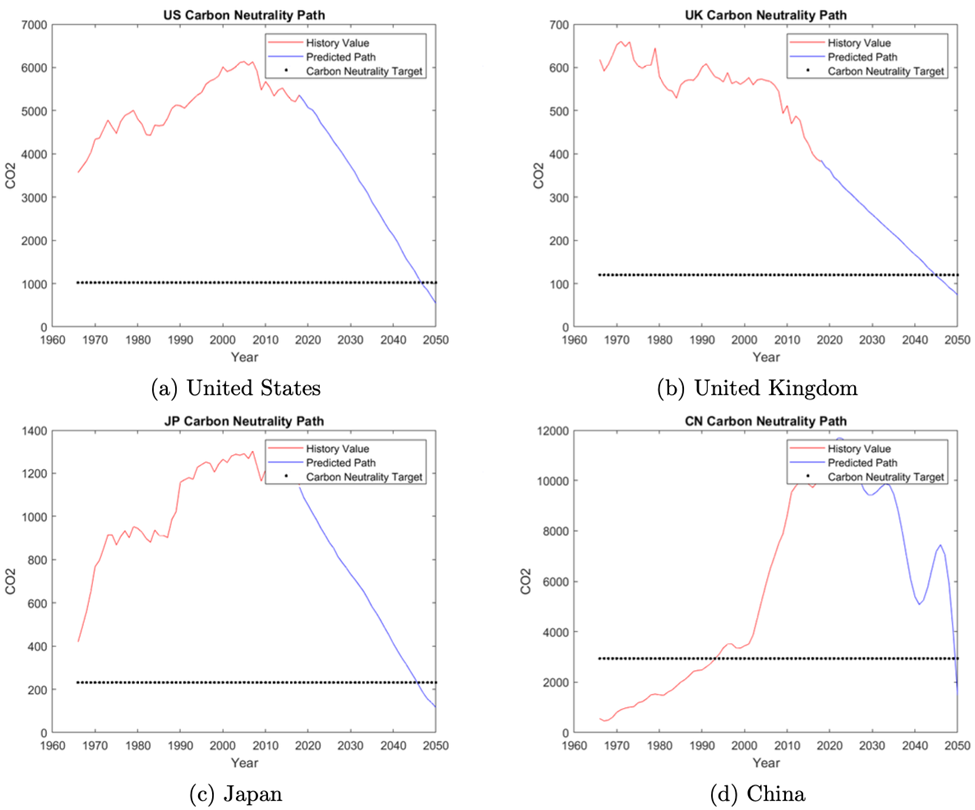

- predict carbon emission for US, UK, China and Japan with Time Varying Parameter Vector Auto Regression (TVP-VAR) time series model

- add Monte Carlo Simulation to the TVP-VAR Model to simulate the carbon emission path to achieve carbon neutrality goals in 2050.

- introduce Long Short-term Memory Deep Learning model as an alternative way to predict carbon emission

Note: The code and paper for this project is available on GitHub here.

The imperative for addressing climate change extends beyond environmental considerations and has profound implications on the financial sector, necessitating diligent analysis and strategic response. At MathWorks, our Application Engineering team in computational finance is deeply engaged in research pertaining to climate change, specifically in the context of carbon neutrality simulation. Financial institutions are increasingly recognizing the necessity to delineate the multifaceted threats and opportunities associated with climate change, as it has a direct impact on investment portfolios, credit risk, asset valuation, and overall financial stability. Concurrently, financial regulators are committed to comprehensively understanding the ramifications of climate change on the stability of the financial system in order to mitigate systemic risks and ensure long-term sustainability.

In light of these considerations, Yuchen and I are dedicated to conducting rigorous research on carbon neutrality simulation. Our work aims to elucidate the potential pathway to simulate carbon dioxide emission and achieve carbon neutrality. Therefore, our work provides a solid data foundation, so we may further evaluate climate change’s impact on financial parameters and, consequently, the broader financial system. For example, we may predict grains futures price with the carbon emission as a parameter because the climate change heavily impacts grain production. Through the simulation of different scenarios and the assessment of their prospective impacts, we endeavor to equip financial institutions and regulators with the insights necessary to make informed decisions. Our code work is all implemented with MATLAB R2023a.

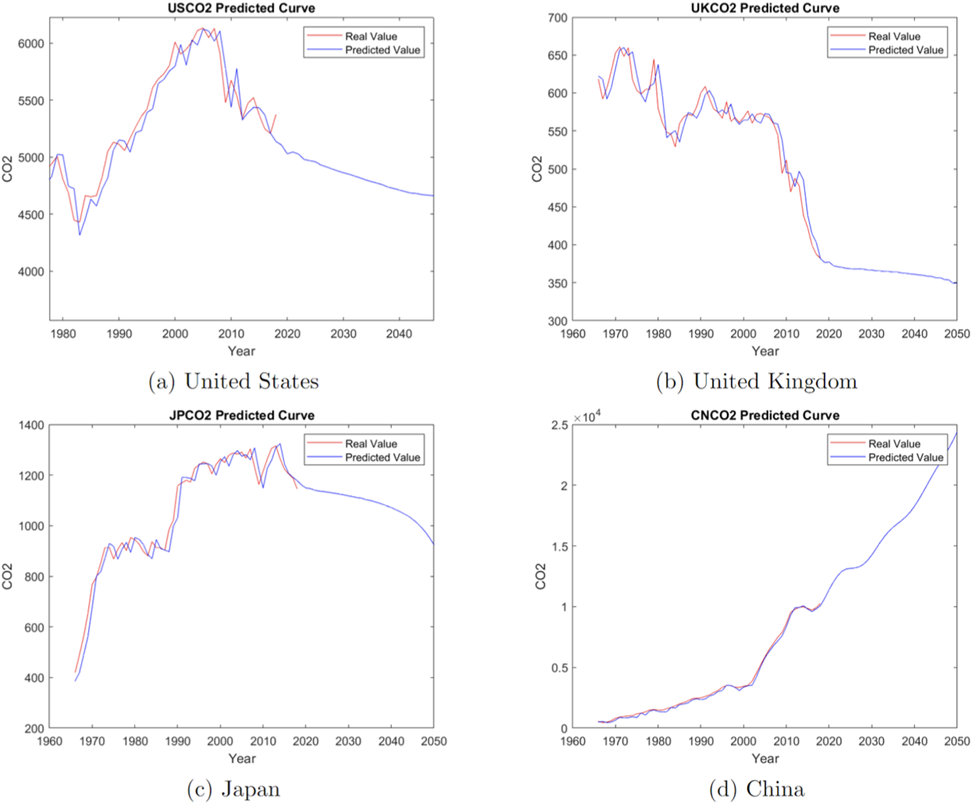

In our research, we firstly conducted time series analysis on carbon dioxide emission prediction with Econometrics Toolbox and Statistics and Machine Learning Toolbox. To be more specific, with the past 80 years of data, we introduced Time Varying Parameter Vector Auto Regression (TVP-VAR) model to forecast how CO2 emission progress in four major developed and developing countries in the next 30 years. Apart from China, US, UK, and Japan have shown a steady decrease in CO2 emission. In particular, we use estimate function in Econometrics Toolbox™ to easily fit autoregressive integrated moving average model to data, serving as an essential step to build up TVP-VAR model.

Time Varying Parameter Vector Auto Regression (TVP-VAR) model to forecast how CO2 emission progress in four major developed and developing countries in the next 30 years.

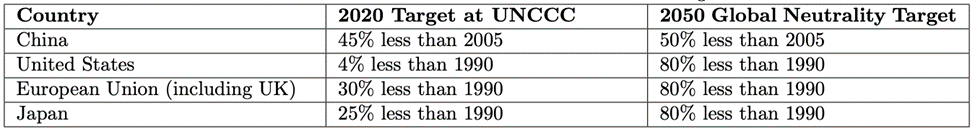

The second insight was achieved by using Monte-Carlo simulation to identify how likely governments can achieve their 2050 carbon neutrality goals as set on the United Nations Framework Convention on Climate Change (UNCCC) in 2020:

2050 Carbon neutrality goals for China, United States, EU and Japan

With Monte-Carlo simulation, we simulated carbon neutrality path 10,000 times, where we find that for around 500 times (5%), selected countries reach their carbon reduction target.

Carbon Neutrality Path Simulation

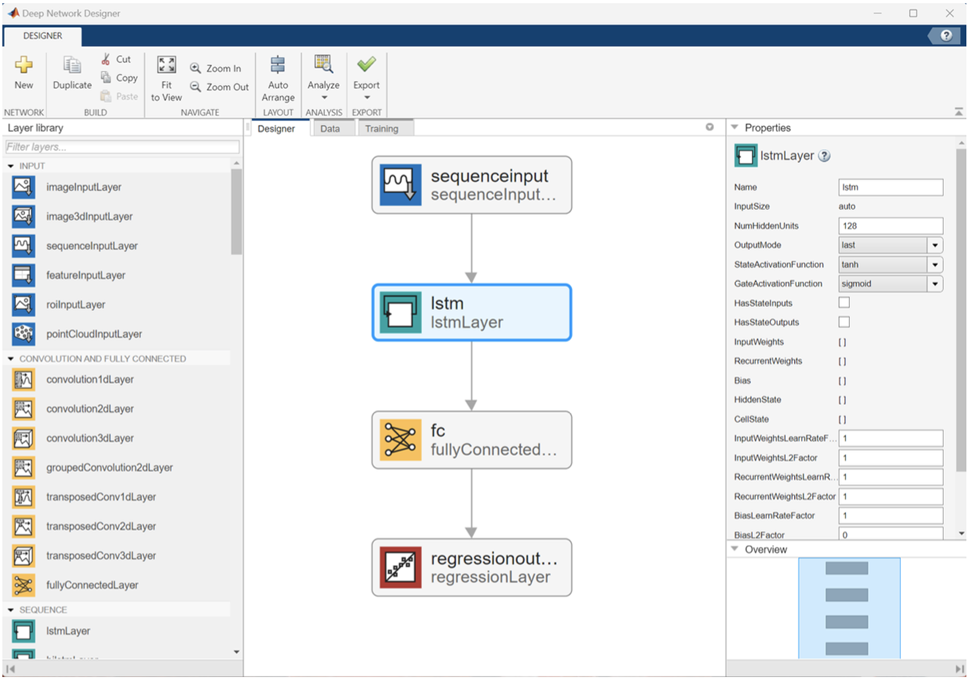

We used Long Short-term Memory (LSTM) model to provide a deep learning perspective in carbon emission simulation. With Deep Learning Toolbox™, we built up an LSTM model using the Deep Network Designer which allows an interactive and low-code way to generate deep learning models. For example, one can implement LSTM with built-in blocks to avoid repetitive debugging using other open-source programming languages.

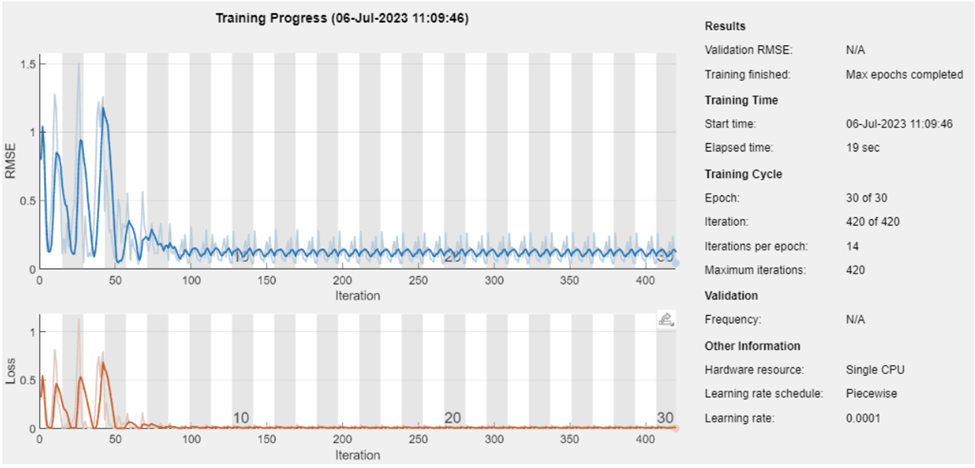

The training result shows a strong model fitness with normalized RMSE less than 0.06.

LSTM model built in the Deep Network Designer

Training output of Deep Network designer with a model RMSE < 0.06

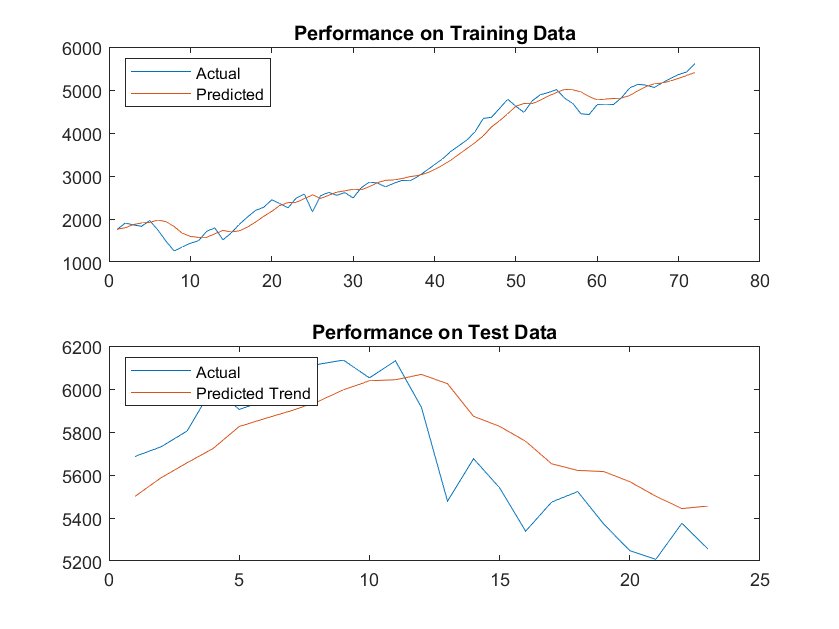

Performance and Result of the LSTM model predicting in yearly timesteps the Carbon output of USA

The use of the LSTM model represents a promising step forward in the domain of carbon emissions forecasting, demonstrating the potential on deep learning techniques in environmental modeling and prediction.

Project Conclusion:

This research underscores the need for heightened urgency and action to mitigate carbon emissions in the US, UK, Japan, and China. Despite the sobering results, our findings should serve as a wake-up call to prompt more significant commitment and innovative strategies to achieve the ambitious goal of carbon neutrality by 2050. Our research illustrates the utility of advanced statistical and deep learning models in forecasting carbon emissions, paving the way for their further application in environmental research and policy planning. Future work should focus on exploring potential interventions and strategies that can alter the current trajectory and increase the probability of achieving the carbon neutrality targets.

Summary:

This collaboration inspired me to join MathWorks’ Engineering Development Group (EDG), where new graduates can rotate among different teams to unlock their potential. The onboarding process was smooth, and from day one, I felt welcomed and supported. I was exposed to a wide range of engineering opportunities, allowing me to explore various domains and expand my skill set.

Throughout my time with MathWorks, I received unwavering support from my EDG manager, Jason Jumper, and the Application Engineering manager, David Willingham. Their guidance, mentorship, and belief in my abilities played a pivotal role in my growth and success.

Reflecting on my experience, I wholeheartedly encourage aspiring students to consider joining MathWorks. The Innovation Excellence Project offers a unique opportunity to work on exciting projects, collaborate with brilliant minds, and make a meaningful impact. If you are seeking an environment that nurtures your skills, challenges you to push boundaries, and provides a platform to create a better future, then MathWorks is the place for you. Join us on this incredible journey and be a part of unleashing the power of innovation.

- カテゴリ:

- Climate Finance,

- New Features

コメント

コメントを残すには、ここ をクリックして MathWorks アカウントにサインインするか新しい MathWorks アカウントを作成します。