Pricing Special Purpose Vehicles with Physics‑Informed Neural Networks at Nasdaq Private Market

Summary

Nasdaq Private Market (NPM) used MATLAB® to prototype and scale physics‑informed neural networks (PINNs) that price Special Purpose Vehicles (SPVs) with embedded carried interest and uncertain exit timing.

“Deep Learning Toolbox™ allowed me to prototype quickly, like for example using Deep Network Designer, and very few moving parts. In other words, I could spin out my proof of concept very fast.”

— Chetan Jadhav, Senior Data Scientist, Nasdaq Private Markets

Watch the video: Special Purpose Vehicle (SPV) Pricing Using Physics-Informed Neural Networks

Key Outcomes

-

Pricing with domain knowledge and AI: NPM prices SPVs by treating carried interest as an embedded option and modeling uncertain exit timing. The models include carry and fees for structure‑aware valuation.

-

Prototyping and scaling in MATLAB: The team trained PINNs with Deep Learning Toolbox™ and Parallel Computing Toolbox™, distributing Monte Carlo simulations across GPUs on AWS. On a four‑GPU instance, they report about an 800× speedup versus a laptop, enabling rapid iteration.

-

Accuracy and structure detection: PINNs tracked SPV price moves and surfaced structural pricing patterns in private trades. The networks aligned with theory and showed less overfitting on synthetic validation.

-

Technical collaboration: NPM worked with MathWorks Consulting Services to refine the modeling workflow and optimize deployment on AWS.

“They [MathWorks technical support] even answer your model-related questions”

— Chetan Jadhav

Engineering the SPV Pricing Workflow

SPVs are hard to value because of illiquidity, opaque prices, and embedded carry. Rather than fold carry into an ad‑hoc discount, NPM modeled it as a short call embedded in the SPV. Liquidity events (for example, IPOs or acquisitions) are random, which makes maturity stochastic and decouples valuation from a fixed maturity date. Daily price and volatility signals from Tape D® anchored parameters for simulation and validation.

Why Physics-Informed Neural Networks

PINNs combine machine learning with the rigor of differential equations. Instead of only fitting data, they learn to satisfy the governing Black–Scholes‑type PDE with liquidity risk, carry fees, and other embedded terms. This lets the model work with thin or synthetic datasets by enforcing known relationships in the loss function. For NPM, that meant training on synthetic Monte Carlo samples when real SPV trade data was limited—while keeping financial realism and interpretability.

“PINNs are a great fit for SPV pricing … They don’t just fit the data — they learn the solution of the equation.”

— Chetan Jadhav

This design allows PINNs to handle thin or synthetic datasets by enforcing known relationships through their loss function. For NASDAQ Private Markets, this meant the models could be trained entirely on synthetic Monte Carlo samples when real SPV trade data was limited, while still preserving financial realism and interpretability.

Model Development and Training

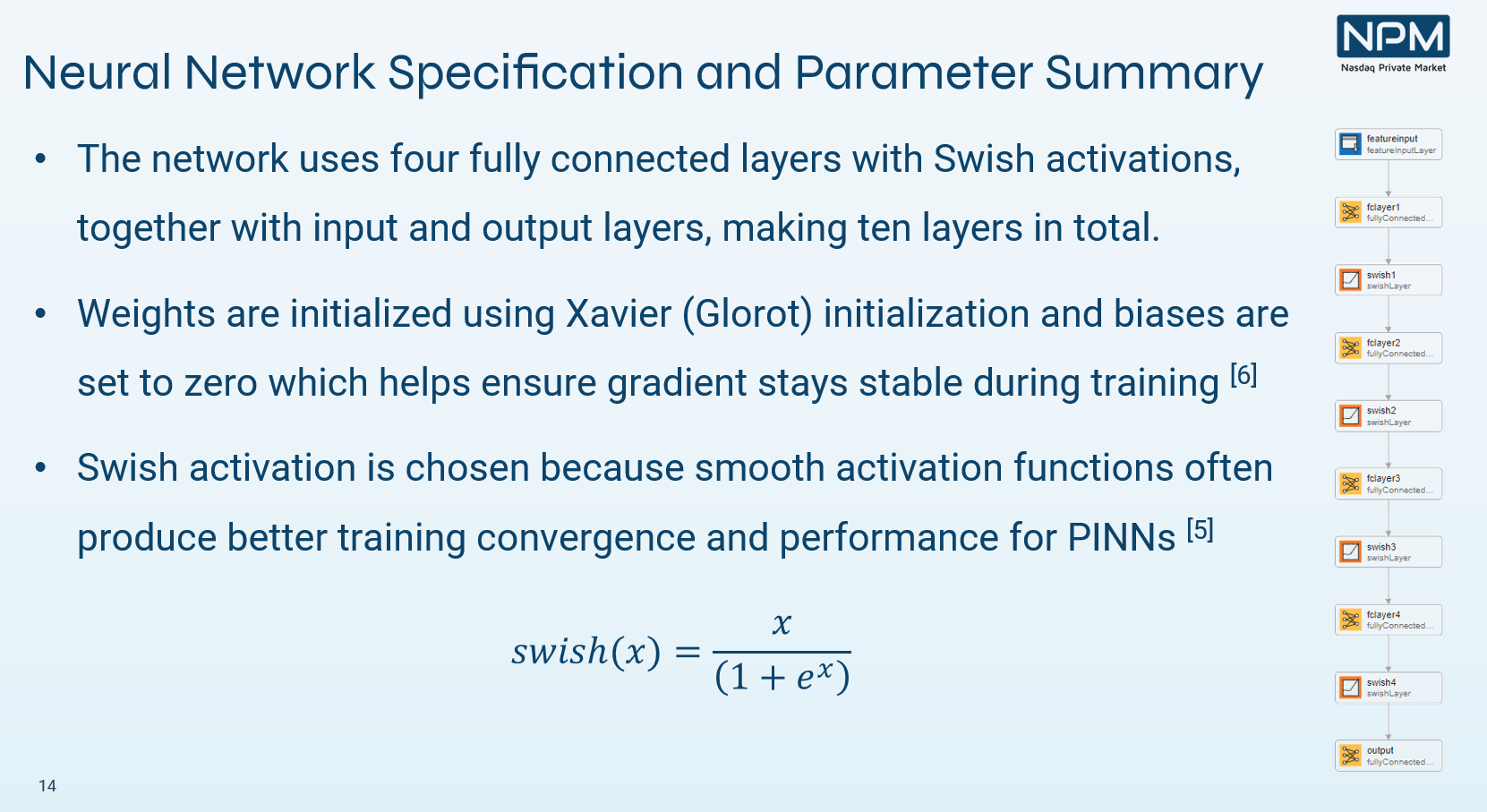

The team built a custom 10‑layer network in the Deep Network Designer app, using swish activations and tuned initialization. Training combined loss terms for PDE residuals, boundary conditions, and Monte Carlo‑based components to improve stability and accuracy. Focused sampling near payoff kinks improved precision.

With Parallel Computing Toolbox™, they distributed Monte Carlo simulation across multiple GPUs on AWS, achieving the reported ~800× acceleration versus single‑machine runs. They streamlined training and deployment with MATLAB Compiler SDK™ and Docker® containers on AWS App Runner for reproducible, cloud‑based inference.

Results and Insights

Once trained, the PINNs tracked SPV price movements and revealed consistent discounts in certain private trades relative to model‑based fair values. This pattern suggests that some carry terms may be underpriced—useful insight for investors and issuers. Compared with ensemble regression on limited real data, the PINNs were closer to theoretical ground truth and generalized better to synthetic validation sets, indicating lower overfitting risk.

Scaling and Operational Impact

Using MATLAB on AWS, NPM built an end‑to‑end workflow—from prototyping to cloud deployment—without heavy rewrites. Hybrid CPU/GPU scaling let the team use compute efficiently, and Docker made inference portable across development and production.

“This approach would not be possible without [our daily pricing and volatility product]. … Some of the recent improvements in this product were developed in collaboration with the MathWorks consulting team.”

— Chetan Jadhav

Outcome

A consistent, scalable pricing workflow that helps investors, sellers, and intermediaries compare SPVs more confidently.

コメント

コメントを残すには、ここ をクリックして MathWorks アカウントにサインインするか新しい MathWorks アカウントを作成します。