Highlights from the MathWorks Finance Conference 2024

The 2024 MathWorks Finance Conference brought together industry leaders to explore the evolving landscape of finance technology, with a focus on MATLAB applications. Across two days, participants shared insights on areas ranging from sustainable finance to advanced modeling techniques. Here’s a summary of the presentations and key takeaways.

Day 1: Sustainability, AI, and Financial Innovation

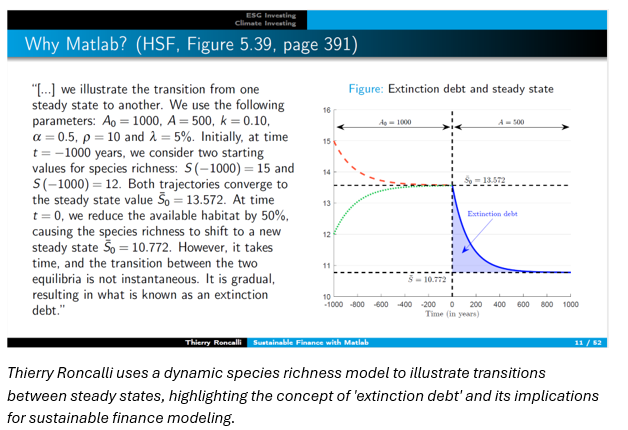

Keynote: Sustainable Finance with MATLAB by Thierry Roncalli (Amundi) Thierry opened the conference by illustrating the application of MATLAB in ESG and climate finance. He discussed practical portfolio decarbonization and stress testing techniques, complemented by resources from his comprehensive Handbook of Sustainable Finance. Watch Thierry’s keynote here.

Innovations in AI-Powered Financial Services by Paul Peeling (MathWorks) Paul offered a roadmap for integrating AI into financial services, highlighting methods to build trust in AI systems through robust validation and governance practices. His presentation underscored the importance of balancing innovation with regulatory compliance. View Paul’s talk here.

Navigating Climate Finance: Solutions for Risk Management by Elre Oldewage (MathWorks) Elre shared examples of how MathWorks tools are used to assess climate-related risks, including flood and cyclone impact analyses. The session demonstrated how geocoding and scenario modeling can inform decision-making. Catch Elre’s presentation.

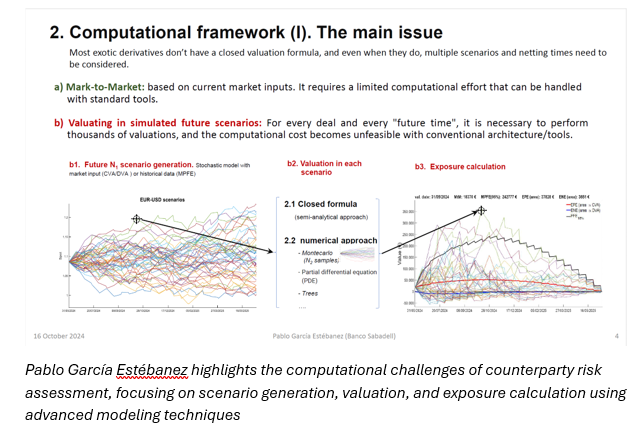

Counterparty Risk Assessment by Pablo García Estébanez (Banco Sabadell) Pablo presented a two-step Monte Carlo approach to counterparty risk management, leveraging parallel computing for efficient risk exposure assessment. This was particularly relevant for attendees dealing with complex financial derivatives. Watch Pablo’s session.

Automation of Internal Models by Christian Dzierzon (Hannover Re) Christian’s talk explored the use of MATLAB for automating internal risk models in the (re)insurance sector. By integrating Monte Carlo simulations and compliance-focused reporting, he highlighted ways to streamline risk management processes. Replay Christian’s insights here.

Wealth & Asset Management Platform by Martin Tarlie (GMO) Closing Day 1, Martin showcased Nebo Wealth, a platform built with MATLAB Web App Server to enhance personalized asset management. The session focused on delivering tailored investment experiences at scale. Explore Martin’s platform demo.

Day 2: Advanced Modeling and Macroeconomic Insights

Advanced Financial Modeling with MATLAB by Alexander Diethert (MathWorks) Alexander provided an overview of innovative modeling tools and data management practices. His presentation discussed AI-powered solutions and practical approaches to streamlining financial workflows using MATLAB. Watch the presentation.

RISE Toolbox for Macroeconomic Models by Junior Maih (Norges Bank) Junior presented the RISE Toolbox, emphasizing its application in modeling regime-switching macroeconomic scenarios. His examples, based on historical economic crises, showcased the adaptability and precision of these models. Watch Junior’s talk.

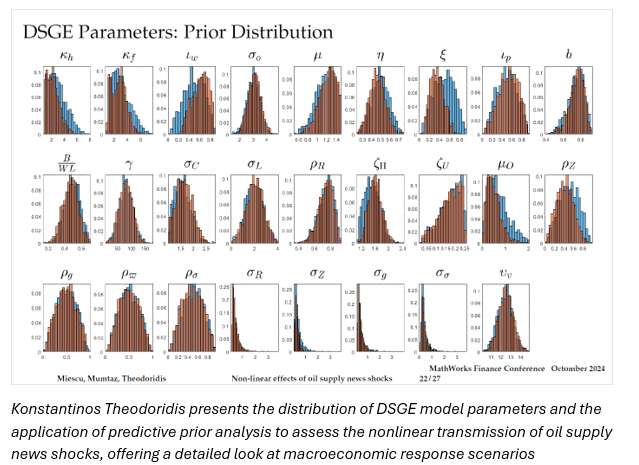

Nonlinear Dynamics of Oil Shocks by Konstantinos Theodoridis (European Stability Mechanism) Konstantinos explored the complex effects of oil shocks on economies using Dynare and MATLAB Parallel Server. His analysis shed light on non-linear economic responses and provided valuable insights for policy analysis. View Konstantinos’ session.

The DIGNAD Model for Economic Resilience by Azar Sultanov & Zamid Aligishiev (IMF) Azar and Zamid discussed the IMF’s DIGNAD model, which evaluates the macroeconomic impacts of natural disasters. Their user-friendly toolkit is designed to inform policy decisions and foster economic resilience. Replay this session here.

ICE Climate Data Insights by Monika Sabolova (ICE) and Marshall Alphonso (MathWorks): Monika and Marshall presented data-driven approaches to understanding decarbonization trends, using detailed emissions data for scenario analysis. This session provided a practical view on aligning financial strategies with climate goals. Catch the session .

Physics-Informed Neural Networks for Option Pricing by Dr. Yuchen Dong (MathWorks) Dr. Dong concluded the conference by demonstrating how Physics-Informed Neural Networks (PINNs) offer an efficient alternative to traditional option pricing methods. This approach merges deep learning with financial modeling. Explore Yuchen’s demo.

댓글

댓글을 남기려면 링크 를 클릭하여 MathWorks 계정에 로그인하거나 계정을 새로 만드십시오.