Analyzing the Financial Risks of Wildfires

We recently hosted a technical webinar focused on analyzing the financial risks of wildfires. Akshay Paul and Yuchen Dong from the MathWorks finance team presented how MATLAB can support financial institutions in quantifying climate-related risks—specifically those linked to wildfire events.

Watch the recording here: Recording

Wildfire Risk Matters

Wildfires are increasing in frequency and severity, with significant impacts on communities, infrastructure, and regional economies. For financial institutions, these events pose direct physical risks to assets and operations, and contribute to rising insurance claims.

Regulatory pressure and investor demand are also driving the need for transparent climate risk disclosures.

Tools for Risk Assessment

The webinar highlighted how MATLAB helps institutions:

- Retrieve and process climate data from sources like Meteomatics

- Analyze wildfire-related indicators such as drought index and Santa Ana wind

- Model financial losses using statistical methods, including generalized Pareto distributions

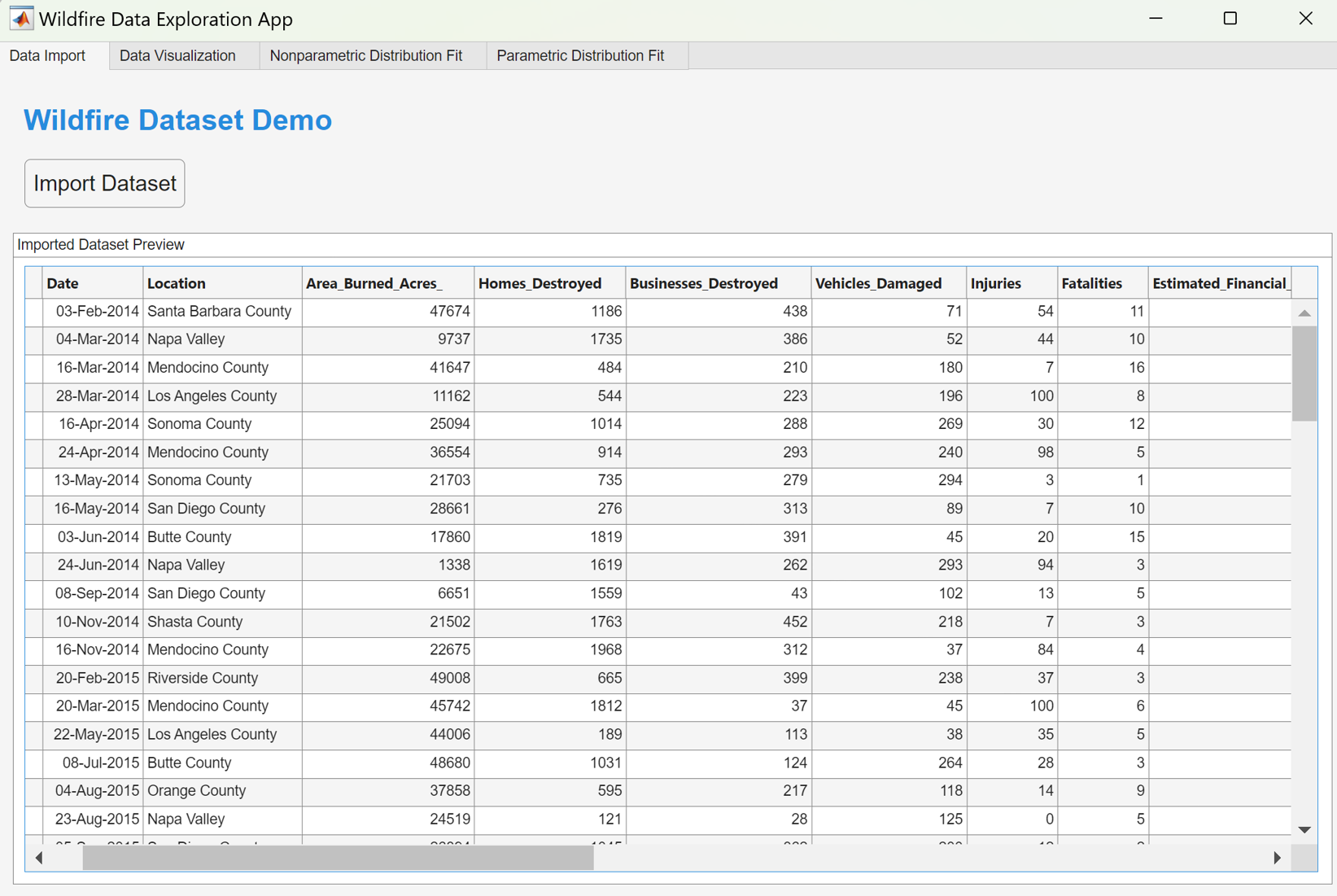

- Build apps to visualize and explore wildfire data across regions and timeframes

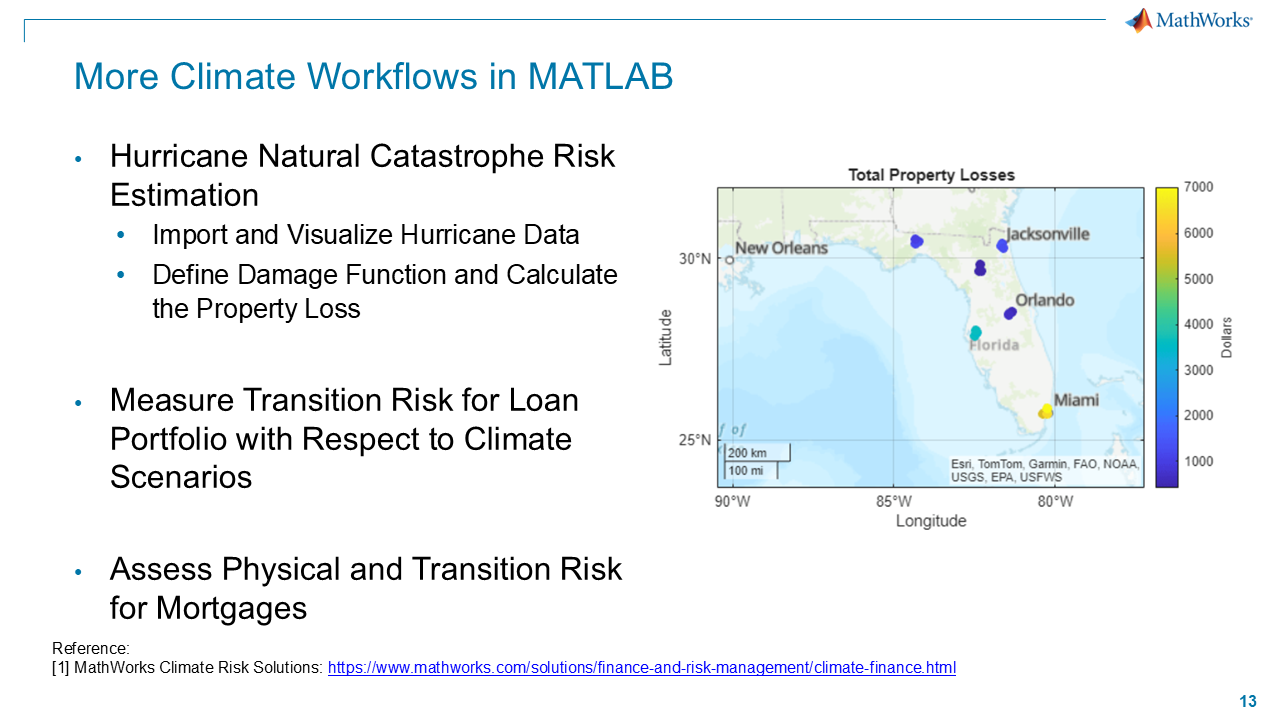

Yuchen demonstrated a workflow that combines climate data with financial loss estimates, using MATLAB App Designer and Mapping Toolbox. The session included examples of how to automate data retrieval, fit parametric and nonparametric distributions, and incorporate climate variables into loss models.

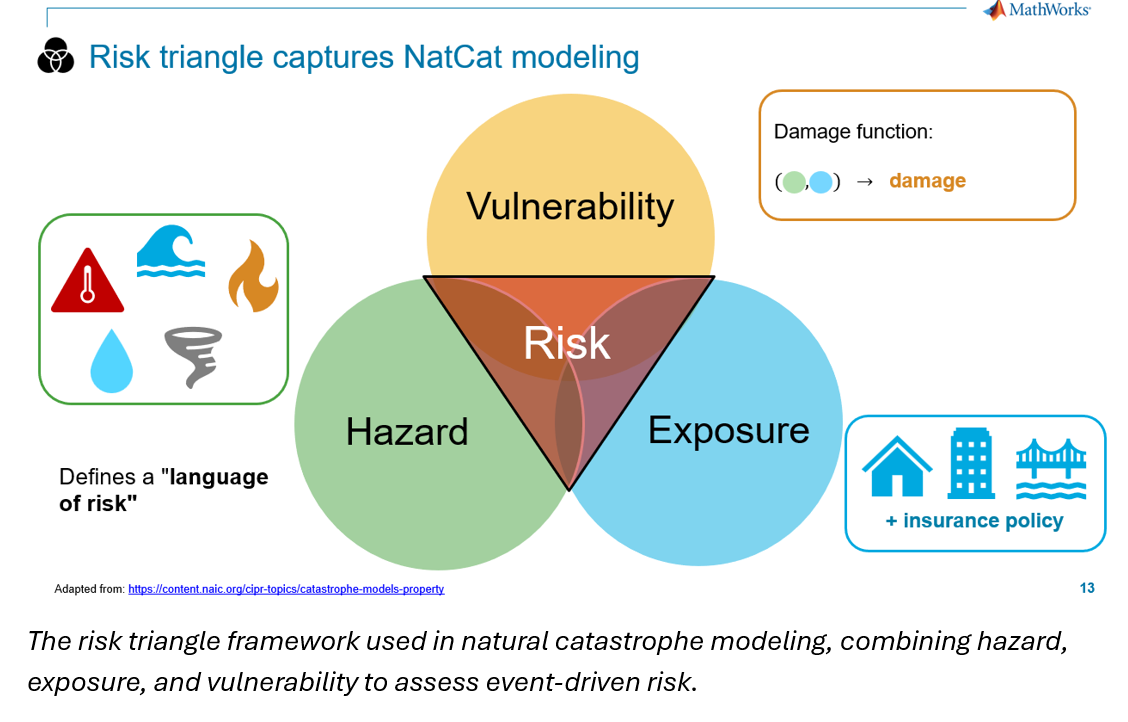

Modeling Losses with Climate Variables

One key focus was the use of covariate models to link climate indicators—such as drought index—to the scale of financial losses. This approach allows institutions to better understand how environmental conditions influence risk exposure and to stress test portfolios under different scenarios.

Looking Ahead

The webinar closed with a reminder that climate risk modeling is not one-size-fits-all. Institutions need flexible, transparent tools that can adapt to evolving data and regulatory requirements. MATLAB provides a customizable framework for building these workflows, helping teams stay ahead of both market and compliance pressures.

If you missed the session, you can view the recording and slides here:

For more information, visit the https://www.mathworks.com/solutions/finance-and-risk-management/climate-finance.html page or contact us at climatefinance@mathworks.com.

- Category:

- Climate Finance

Comments

To leave a comment, please click here to sign in to your MathWorks Account or create a new one.