Highlights from MathWorks Finance Conference 2025

The 2025 MathWorks Finance Conference brought together quants, economists, financial modelers and researchers to explore how MATLAB is shaping the future of finance. Across two days, speakers shared practical applications—from pricing complex instruments to accelerating macroeconomic modelling.

Here are the key highlights.

Day 1: Innovation in Financial Modeling and AI

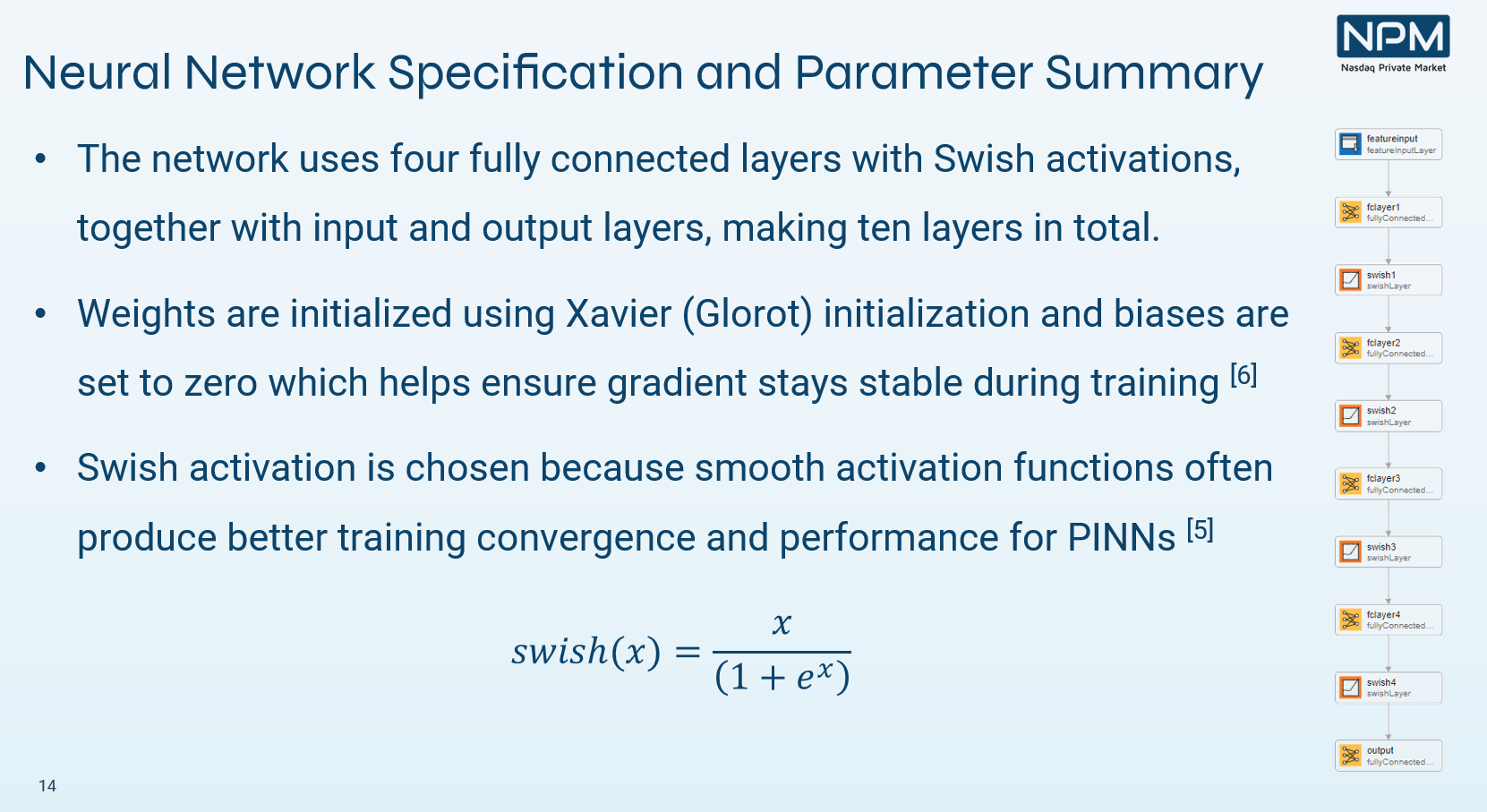

Special Purpose Vehicle (SPV) Pricing Using Physics-Informed Neural Networks

Chetan Jadhav, Nasdaq Private Markets

Chetan introduced a pricing method for Special Purpose Vehicles (SPVs) using Physics-Informed Neural Networks (PINNs). The approach models embedded carry as a stochastic option and trains PINNs on simulated data—offering a transparent method for pricing in illiquid markets.

→ Explore how PINNs outperform traditional models

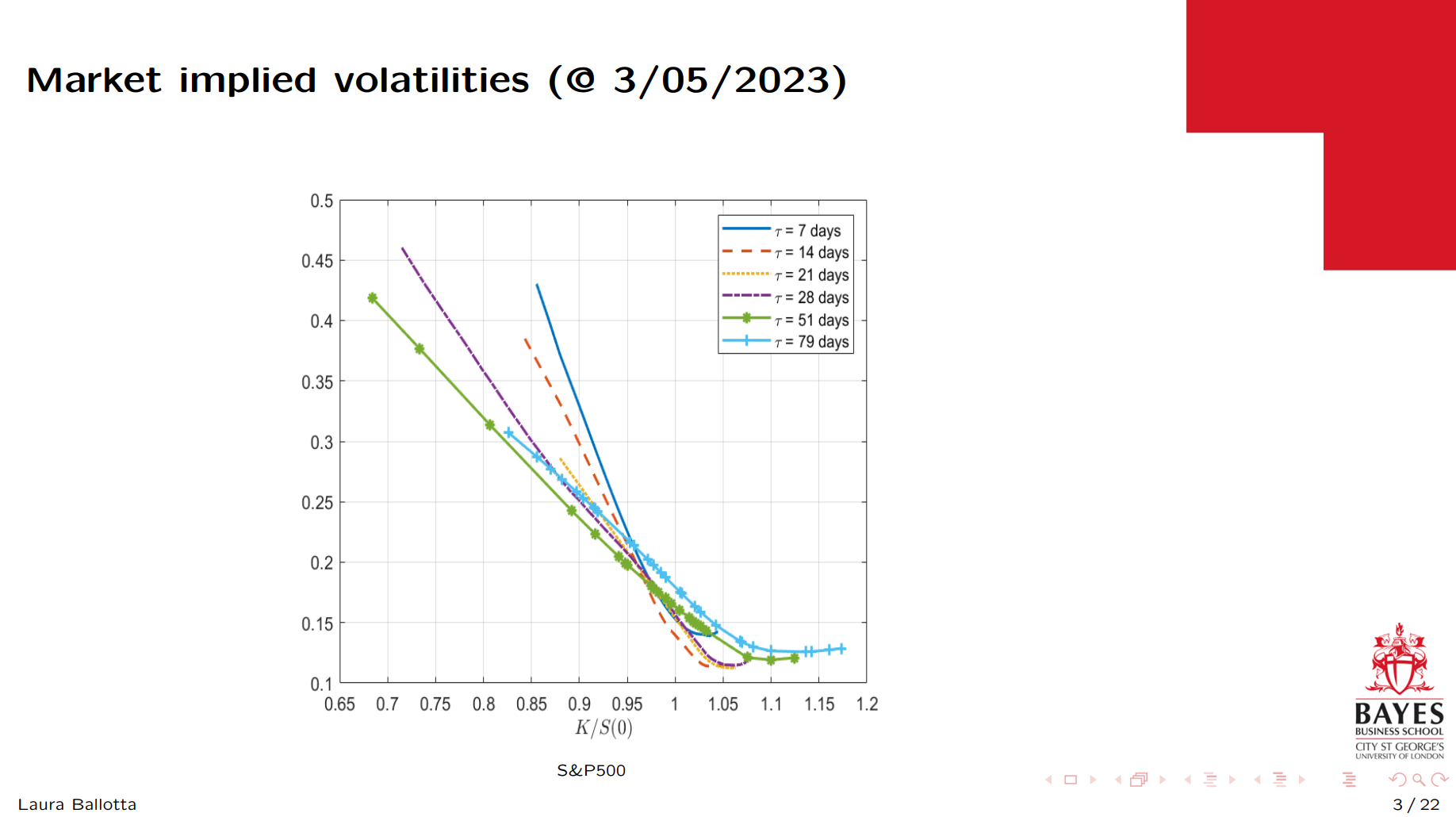

The Calibration Conundrum: Optimizers and (Joint) Objective Functions

Laura Ballotta, Bayes Business School

Laura examined the challenges of calibrating structured derivatives models. She demonstrated how joint objective functions and optimisers interact, and why calibration is more than just curve fitting—it’s about preserving economic meaning.

→ See how calibration choices affect model behaviour

Using MATLAB with Databricks: Orchestrate, Connect, and Deploy at Scale

Michael Browne, MathWorks

Michael showcased how MATLAB integrates with Databricks to support scalable financial workflows. From JDBC queries, to deploying compiled models on Spark clusters, the session highlighted how MATLAB fits into modern data platforms.

→ Learn how to run MATLAB models in Databricks notebooks

MATLAB Copilot: Accelerate Robust Model Development, Testing, and Validation

Lawrence Johny, MathWorks

Lawrence introduced MATLAB Copilot, a generative AI assistant integrated into MATLAB. Copilot assists with code comprehension, authoring, and validation, enabling faster and more robust model development.

→ Learn about MATLAB Copilot’s editor and chat features

Investment Strategies Ideation using Large-Language Models and Structured Multi-Modal Data

Michael Robbins, Taewan Yoon, and Martina Paez Berru, Columbia University

The team presented a pipeline for generating investment ideas using large-language models and structured multi-modal data. The team used MATLAB to orchestrate data ingestion, vector analysis, and prompting—surfacing niche strategies overlooked by general models.

→ Discover how structured prompting can uncover contrarian ideas

Day 2: Macroeconomic Modelling and Risk Analysis

David A. Kelley

Federal Reserve Bank of New York

|

Kaustubh

Reserve Bank of India

|

Juan Rubio-Ramírez

Emory University

|

Allan Wright

Central Bank of the Bahamas

|

Eduard Benet Cerdà

MathWorks

|

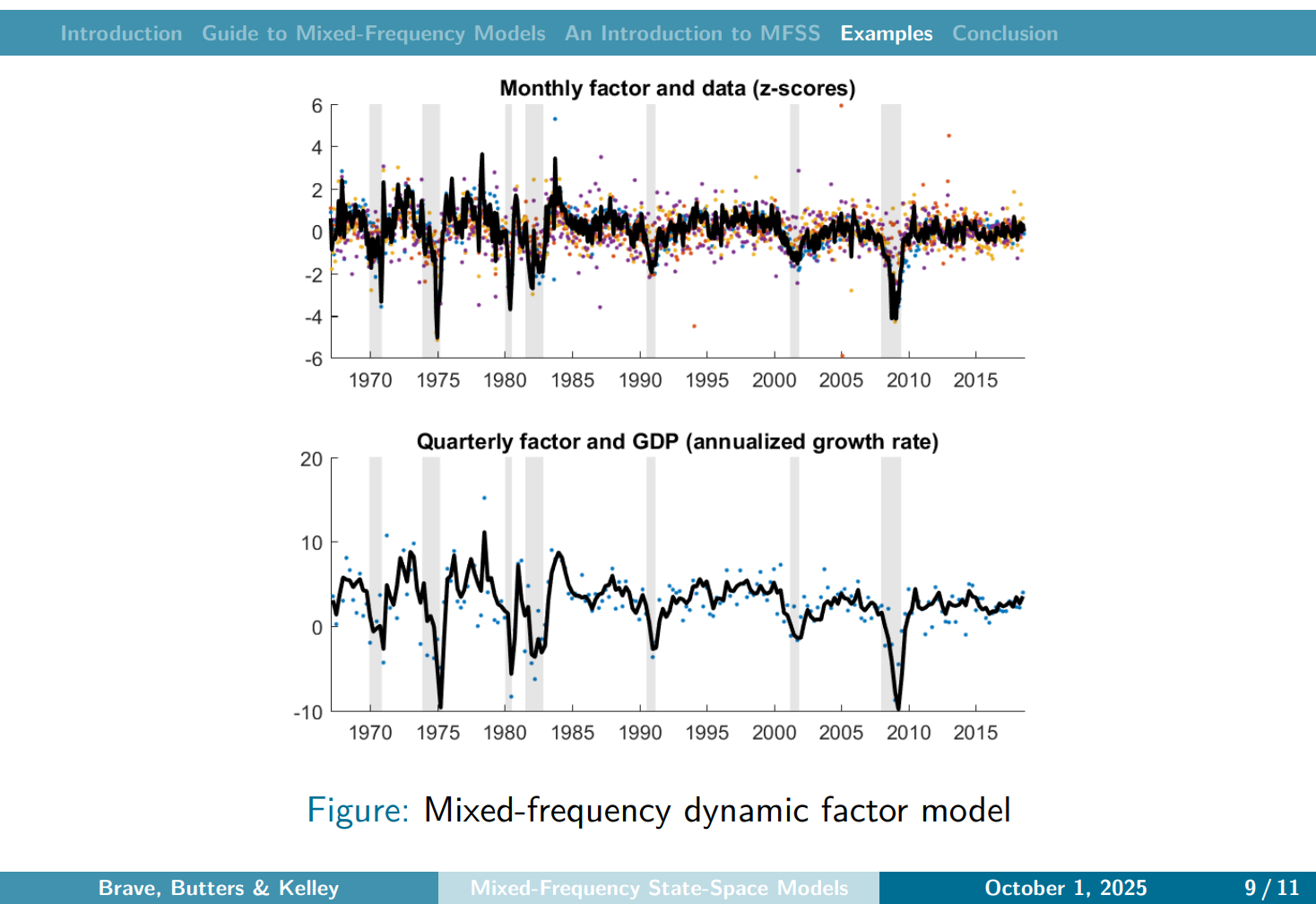

A MATLAB Toolbox for Mixed-Frequency State-Space Models

David Kelley, Federal Reserve Bank of New York

David demonstrated the MFSS toolbox, which simplifies modelling with data observed at different frequencies. David demonstrated how to estimate high-frequency states from mixed inputs, enabling timely forecasts without aggregation loss.

→ See how MFSS handles quarterly and monthly data in this walkthrough

A Multi-Factor Nowcasting Model for India

Kaustubh, Reserve Bank of India

Kaustubh introduced a multi-factor GDP nowcast model using high-frequency indicators. Kaustubh used sigmoid transformations to handle outliers and Kalman filtering to update forecasts in real time.

→ Review the model’s performance across COVID and post-COVID periods

A Gibbs Sampler for Efficient Bayesian Inference Sign-Identified SVARs

Juan Rubio-Ramírez, Emory University

Juan proposed a Gibbs sampler with elliptical slice sampling to estimate large SVARs under tight identification. This method avoids the bottlenecks of accept-reject algorithms and scales to models with many shocks.

→ Learn how this approach improves inference speed

A Dynamic Stochastic General Equilibrium Analysis of a Small Open Economy with Tourism

Allan Wright, Central Bank of The Bahamas

Allan used a DSGE model to simulate the impact of hurricanes on tourism-driven economies. The model showed how climate events drive output and inflation volatility, and how flexible exchange rates can help absorb shocks.

→ View the policy implications for small open economies

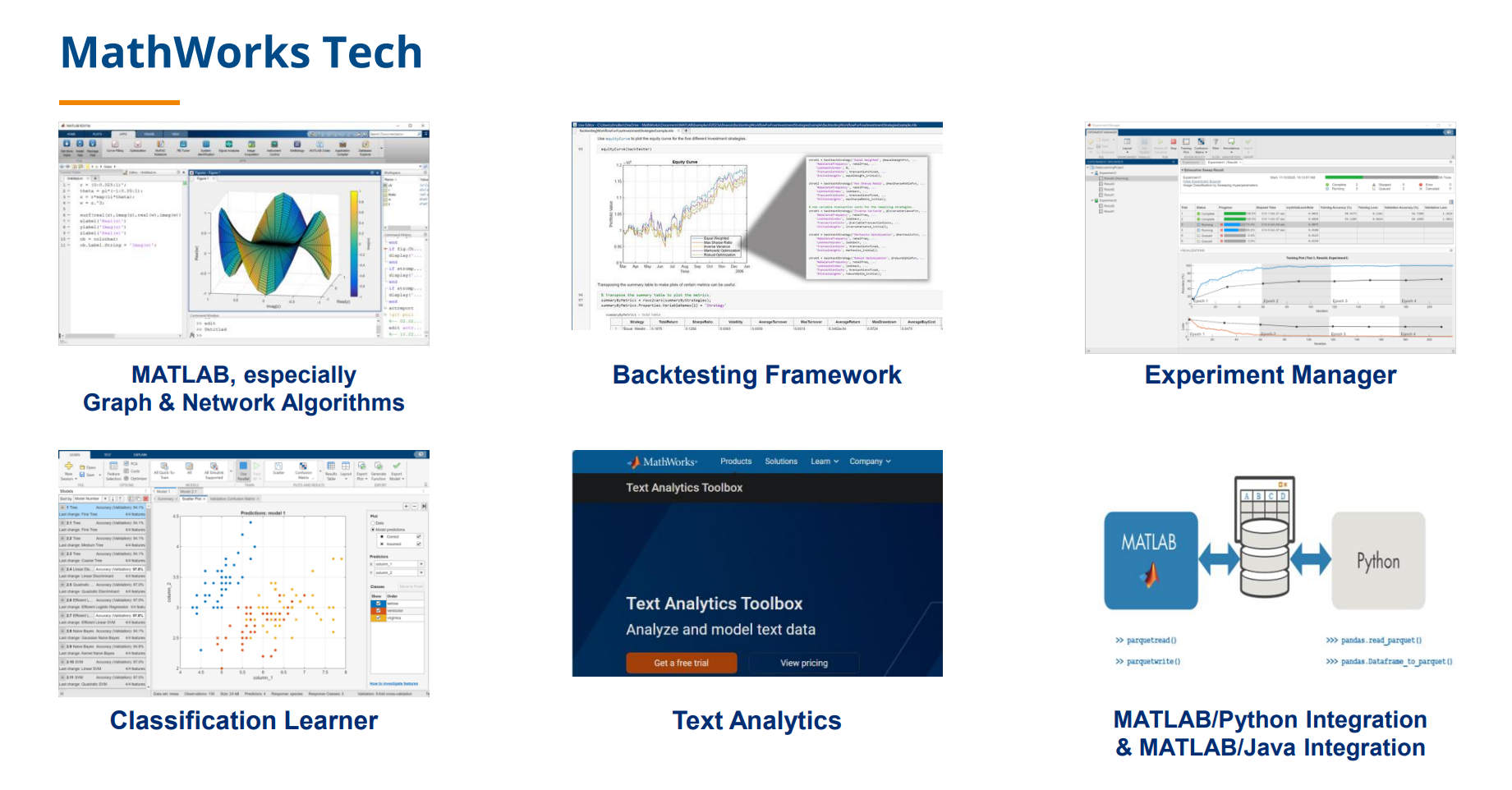

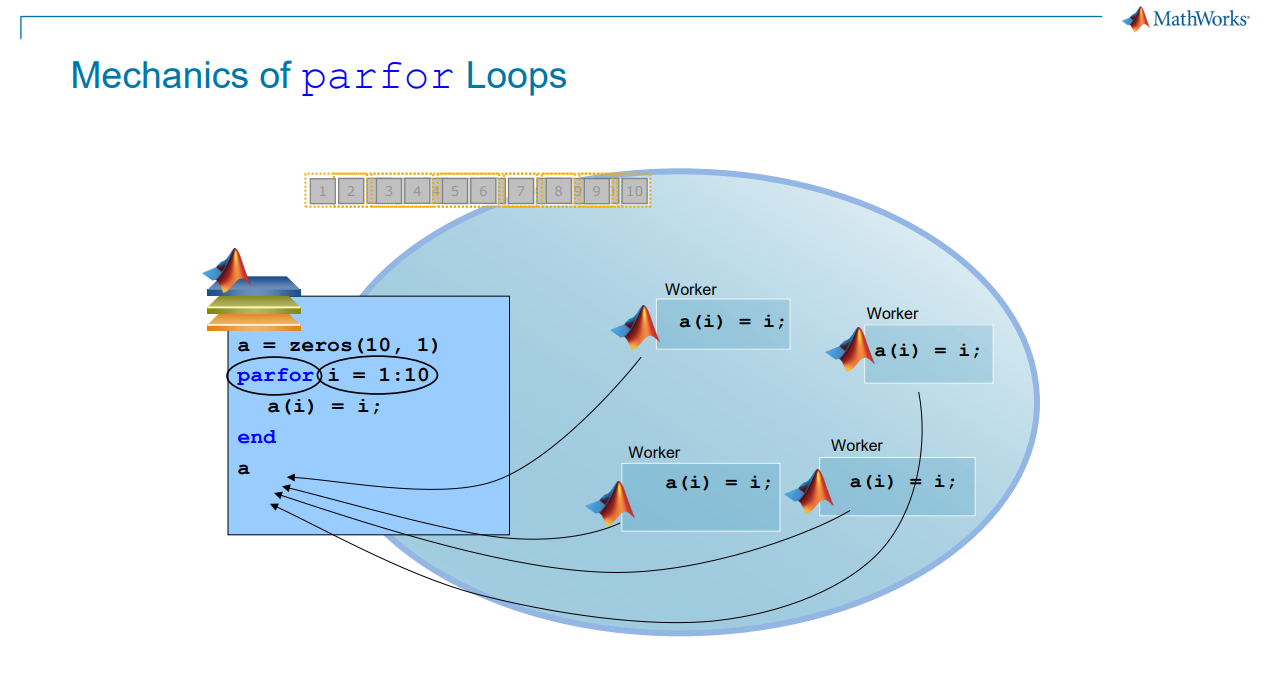

Speed Up Macroeconomic Modeling with MATLAB and Parallel Computing

Eduard Benet Cerdà, MathWorks

Eduard shared practical ways to accelerate macroeconomic models developed in MATLAB, including those based on Dynare. Using MATLAB parallel computing tools—from parfor loops to Experiment Manager—the session covered how to scale estimation tasks across cores and clusters.

→ Find out how to reduce model runtimes from days to hours

If you missed the live sessions, each talk is available on demand. Whether you’re building models, pricing instruments, or forecasting macro trends, the conference offered practical insights for applying MATLAB in finance.

댓글

댓글을 남기려면 링크 를 클릭하여 MathWorks 계정에 로그인하거나 계정을 새로 만드십시오.