Accelerating Model Deployment in Financial Institutions with Automation

Today’s topic is one that’s really making waves in the financial world these days: speeding up the deployment of models using automation. This blog post summarizes a white paper that we recently published which can be found here.

It’s no secret that the financial sector is moving at lightning speed, and with that comes the pressure to manage complex models. These models are crucial for making those big, important decisions—whether it’s assessing risk, ensuring we’re on top of regulatory compliance, or planning strategic moves. But here’s the kicker: sticking to the old-school methods can really slow us down and even add extra risks. So, let’s explore how automation can be a real game-changer.

What’s Holding Us Back?

First off, let’s talk about the chaos that comes with having too many tools and workflows scattered everywhere. We’ve all experienced it and know that its super inefficient and difficult to maintain. If we want to get models up and running quickly, we need to streamline everything and get all those tools working in harmony.

And then there’s the whole collaboration thing. We’ve got all these different teams—modelers, IT folks, compliance experts—who need to work together but are often stuck in their own little silos. We really need to break down those barriers to avoid any delays and misalignments.

Another bottleneck is manual documentation and reporting. It’s a breeding ground for mistakes and makes keeping things transparent a total nightmare.

How Can We Turn Things Around?

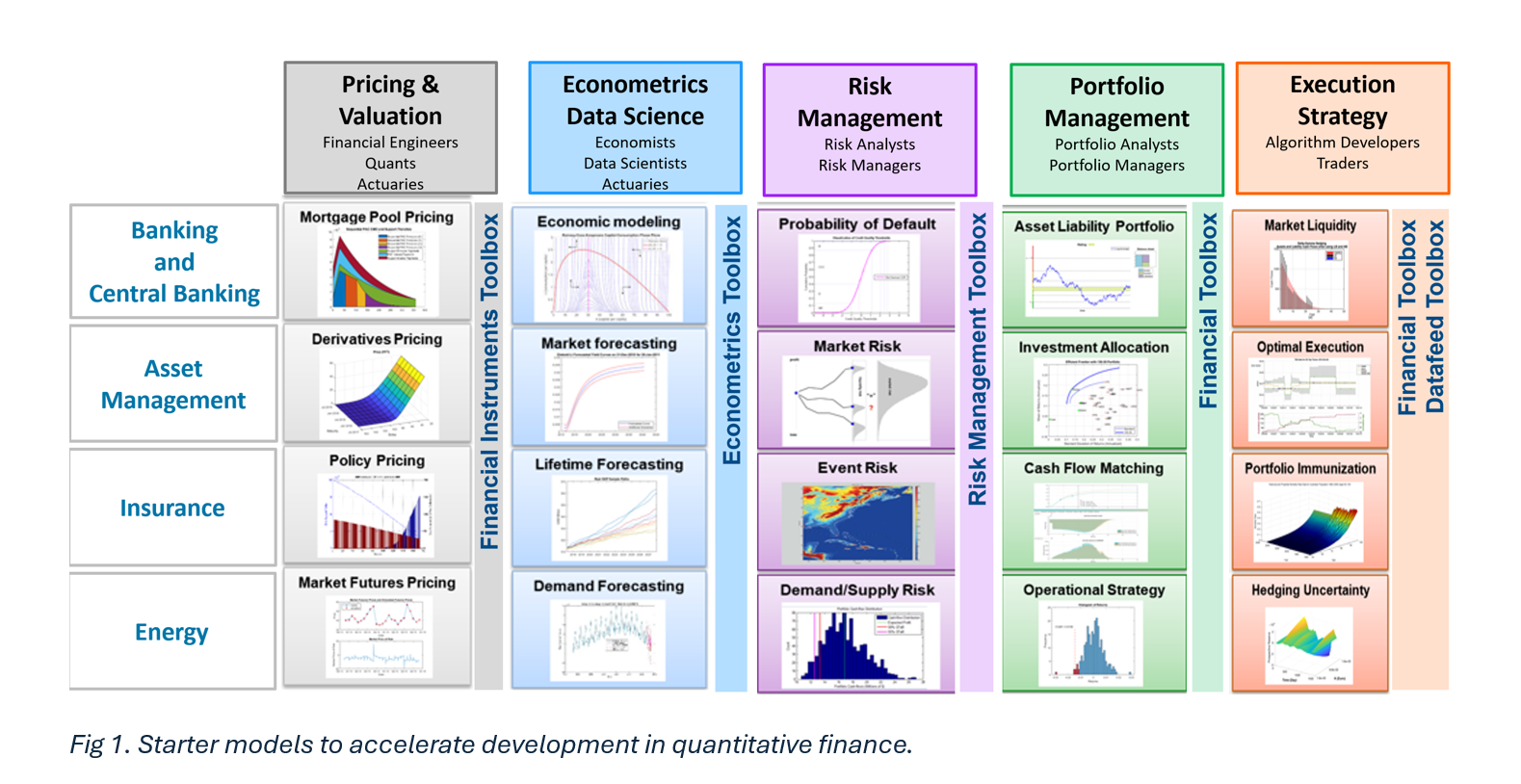

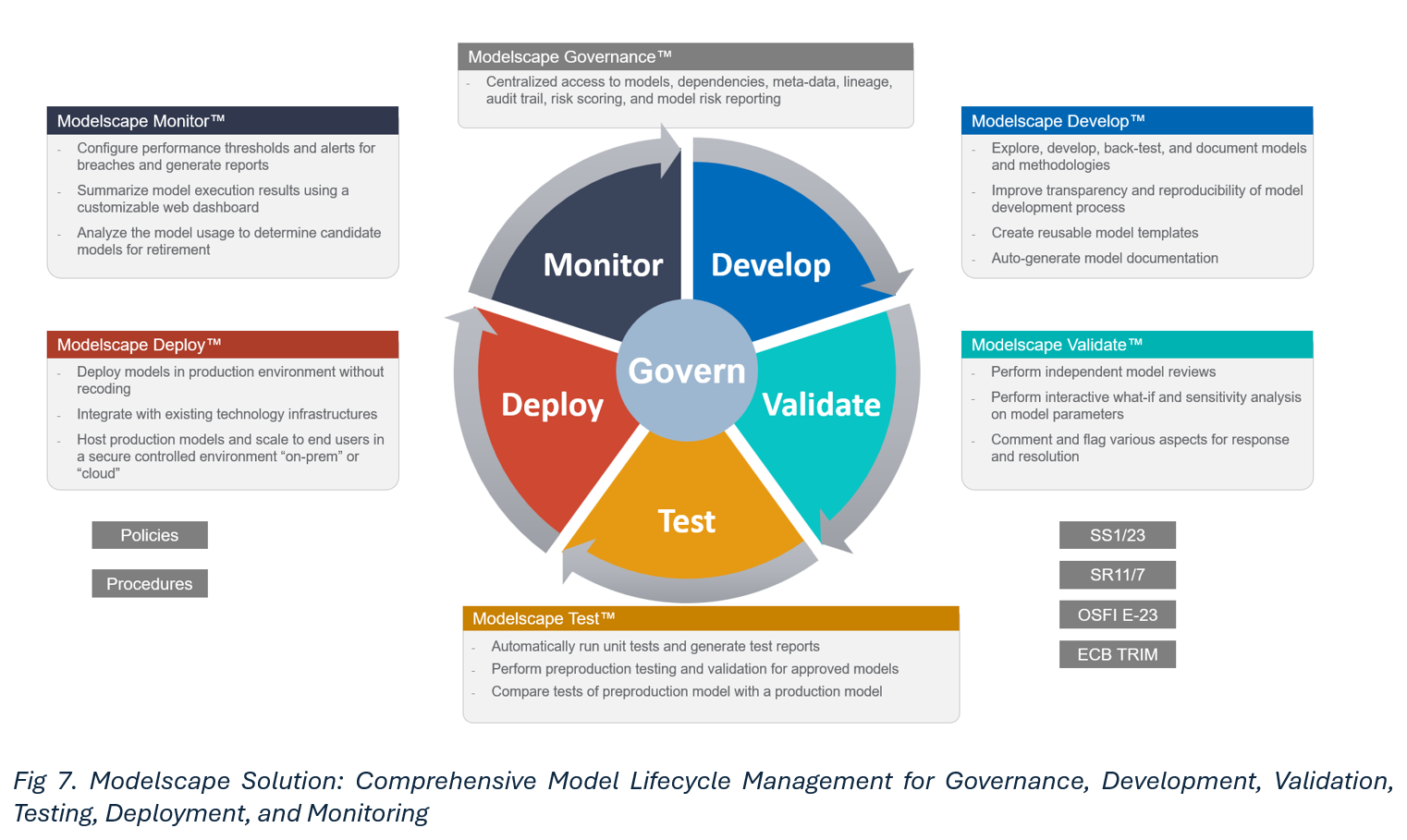

So, what’s the solution? For starters, using prebuilt models can be a real lifesaver. They give teams a head start, so they’re not wasting time reinventing the wheel every single time. It’s all about focusing on the results rather than getting bogged down in building models from scratch.

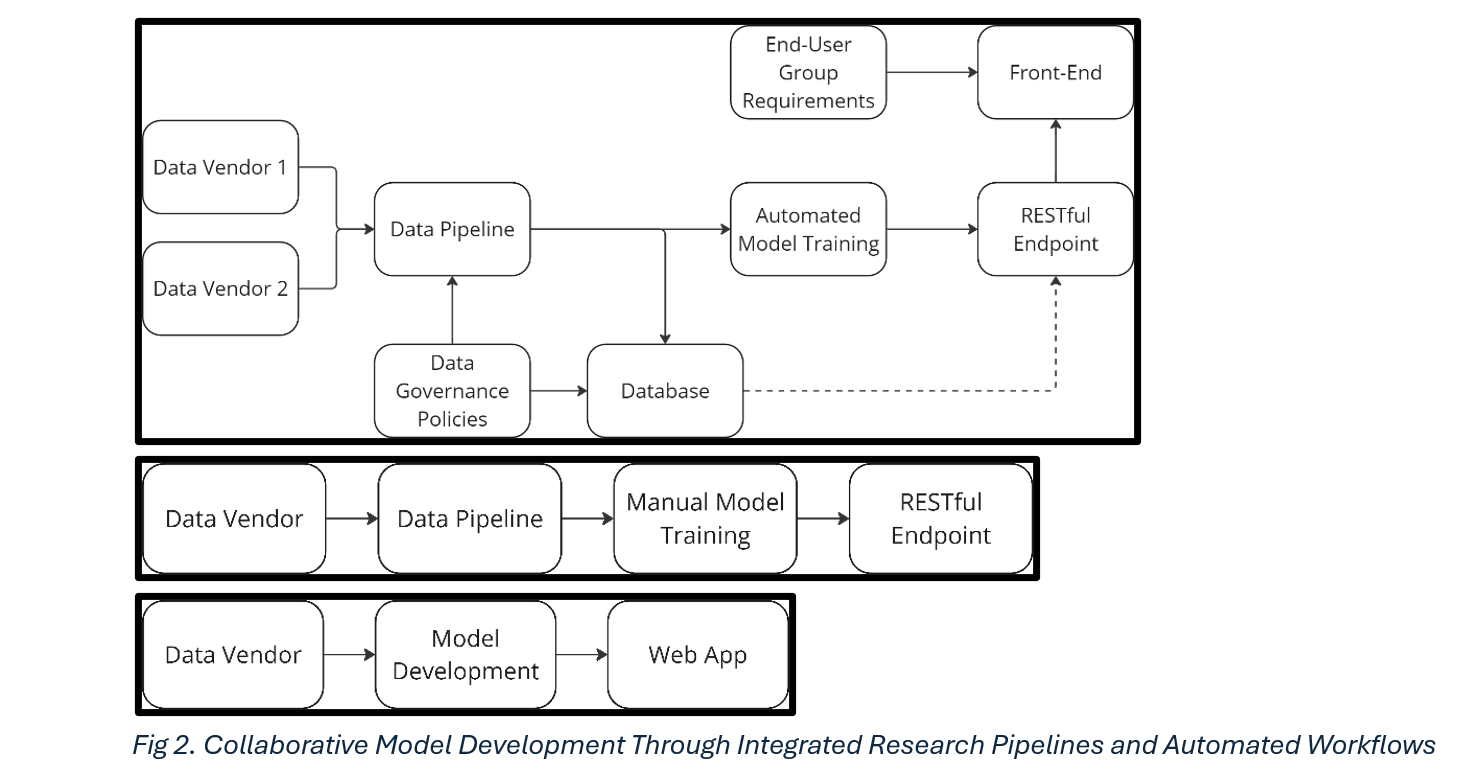

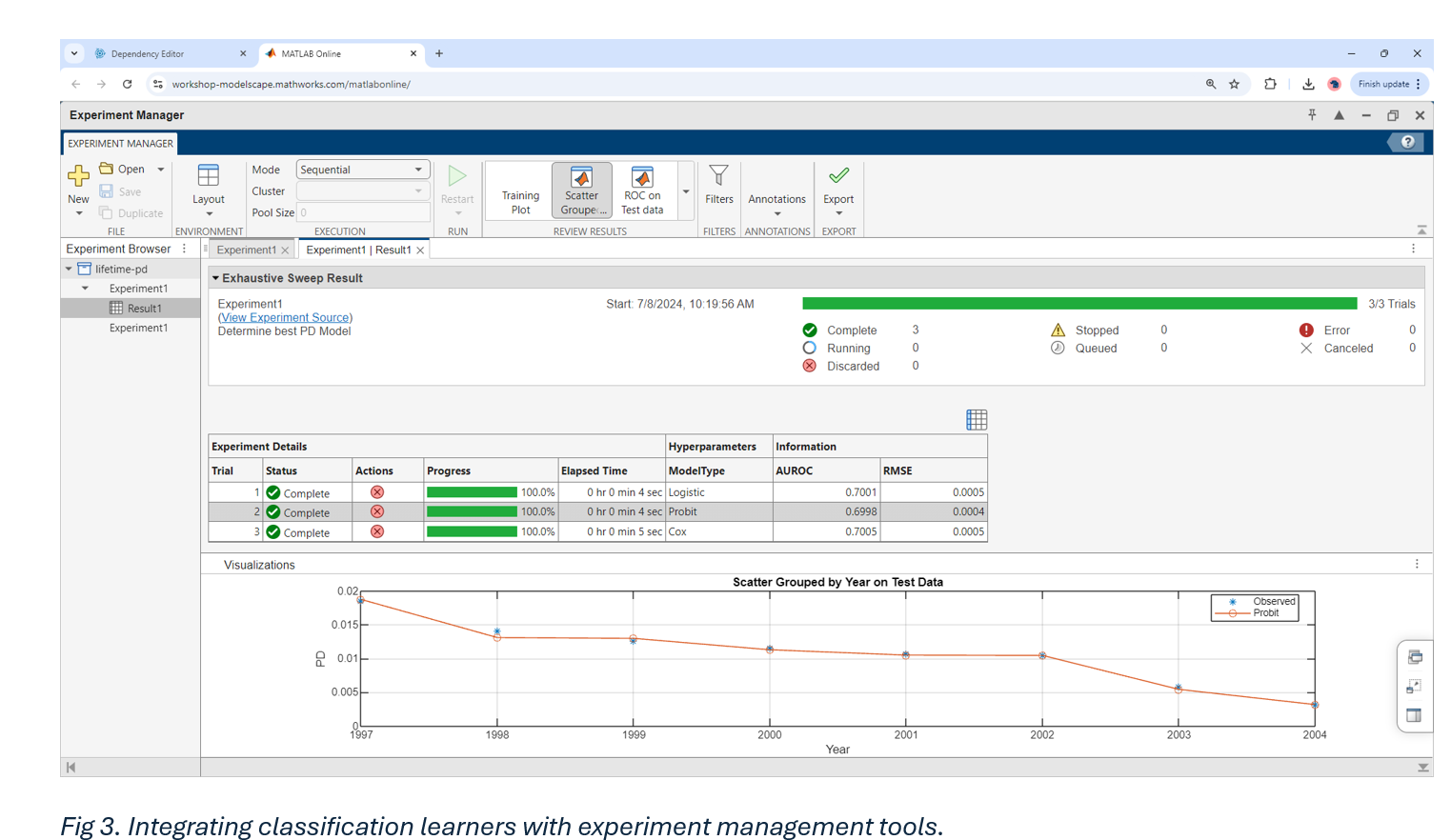

Creating collaborative research pipelines is another brilliant move. It lets teams test out ideas simultaneously and share what they find quickly, which speeds up the whole process and enhances collaboration.

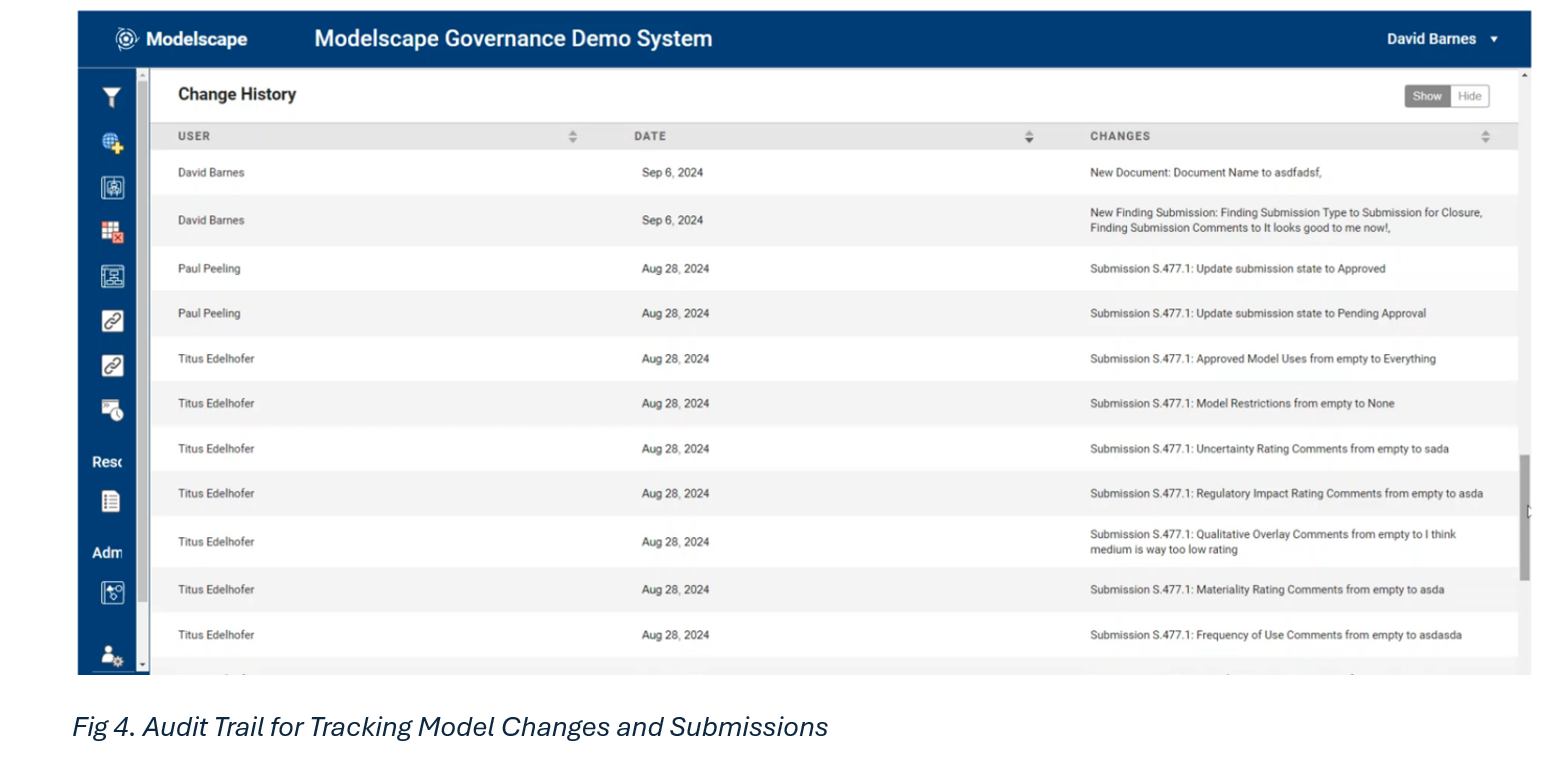

And let’s not forget about automation—automating documentation and tracking is a total game-changer. It keeps everything transparent and audit-ready without all the manual hassle. It’s like having a personal assistant who never sleeps.

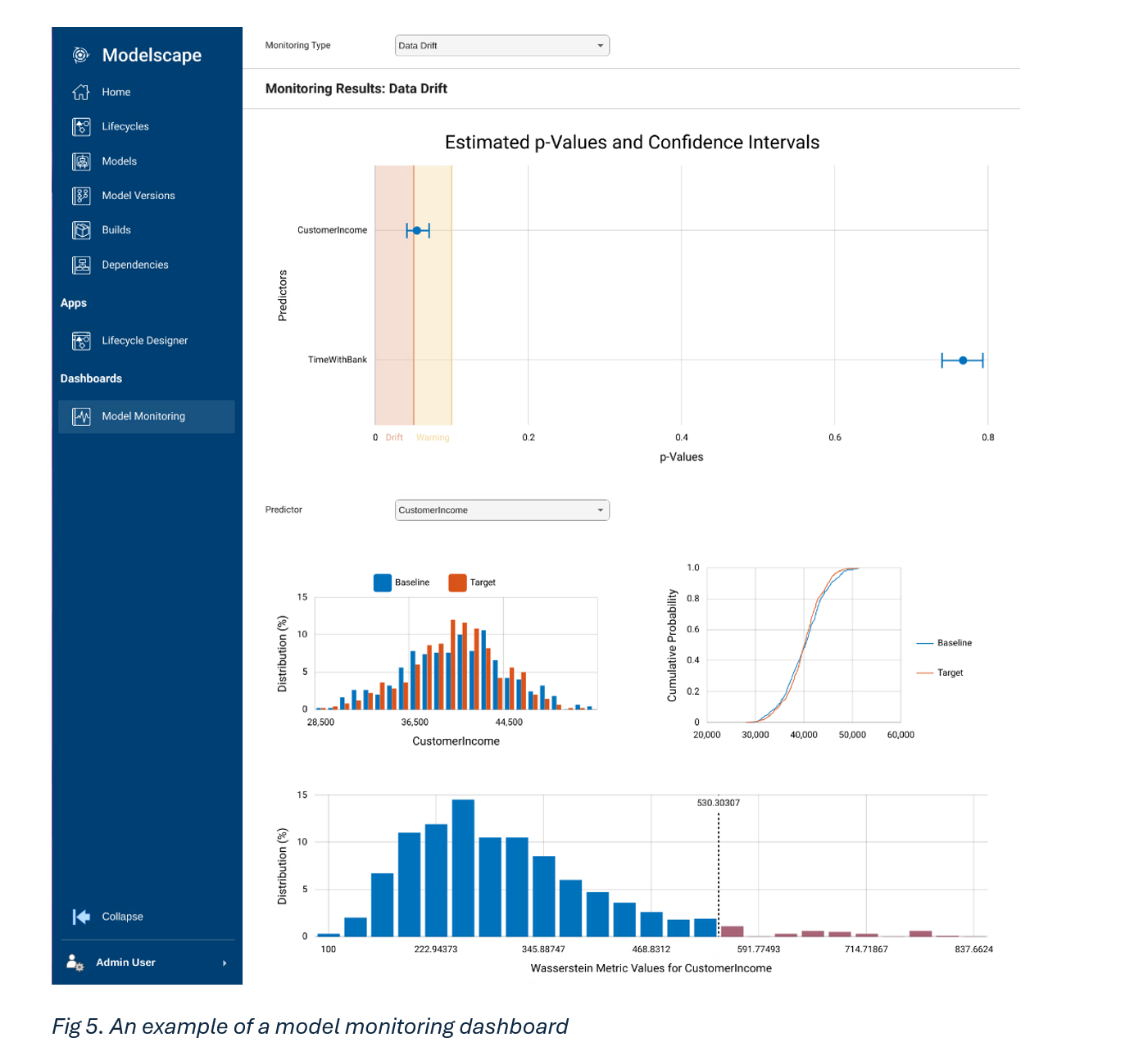

Real-time monitoring with alerts is another great feature to have. It keeps tabs on performance and lets you know if something’s off before it becomes a big issue. It’s all about catching things early and minimizing downtime.

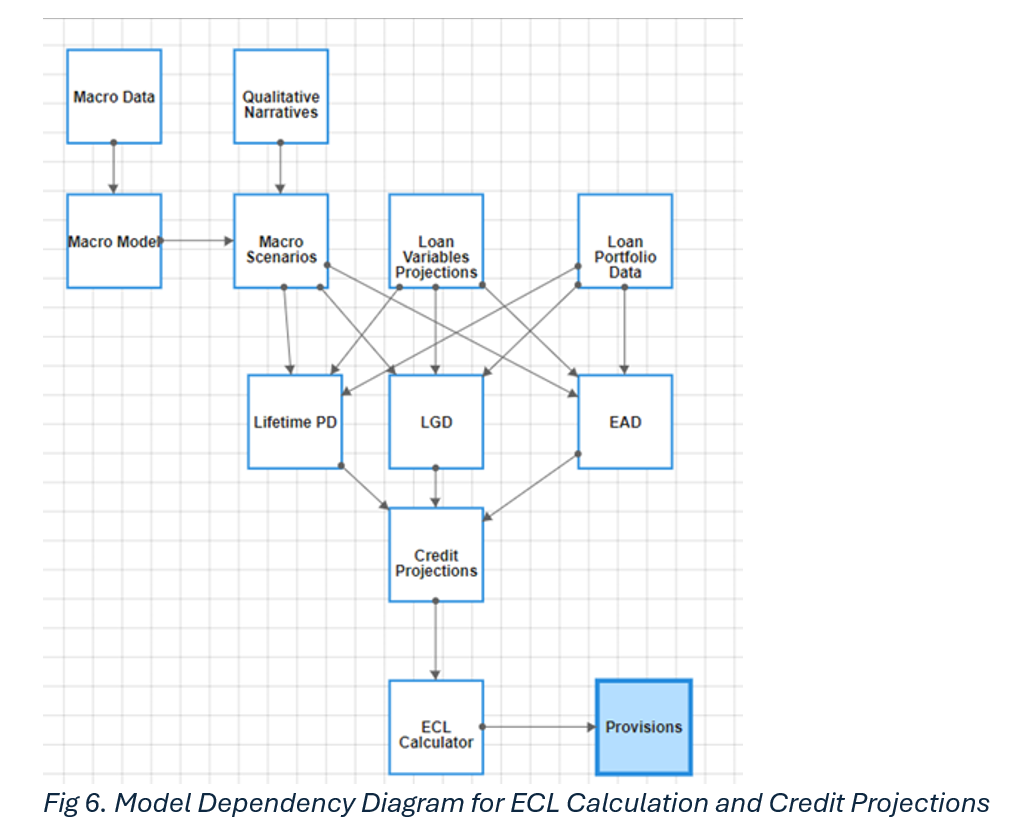

Finally, managing data and model lineage is absolutely crucial. You need to know where your data’s coming from and where it’s going, to keep everything accurate and compliant. It’s all about maintaining integrity and simplifying those audits.

Wrapping It All Up

MathWorks has implemented a unified solution called Modelscape which can do all of the above – and more. It’s all about making things smoother, faster, and more reliable. So, if you’re in the finance game, it’s time to give automation a serious look. It’s not just about keeping up with the pace—it’s about staying ahead and gaining that competitive edge.

Learn more about how Modelscape can transform your model deployment processes at mathworks.com/modelscape.

- Category:

- ModelOps

Comments

To leave a comment, please click here to sign in to your MathWorks Account or create a new one.