Navigating FRTB: Standardized vs Internal Models – and the Role of Scriptable Risk Engines

The Fundamental Review of the Trading Book (FRTB) is reshaping how banks measure and manage market risk. Beyond replacing Value at Risk (VaR) with Expected Shortfall (ES) to better capture tail risk in stressed periods, FRTB tightens the internal models framework, significantly revises the Standardized Approach (SA), and raises the bar on the trading/banking book boundary. At desk level, firms face a practical choice: lean on the SA for predictability, pursue the Internal Models Approach (IMA) for potentially lower capital, or—most realistically—run both in parallel.

At a glance

- SA (Standardized Approach): Formulaic, desk‑level, no prior model approval. It serves as the regulatory fallback and contributes to the Basel output floor (72.5%) used to bound modeled capital.

- IMA (Internal Models Approach): Can better reflect non‑linear risks and reduce capital where desks pass ongoing validation. Requires data pipelines, auditability, and scalable compute.

- Daily computations, rolling decisions: Profit & Loss Attribution (PLA), backtesting, and modellability metrics are computed daily, but pass/fail status is assessed over rolling windows to avoid day‑to‑day flip‑flops.

Why most programs start with SA

SA provides a stable baseline and a common language across desks—useful both operationally and for governance.

SA components

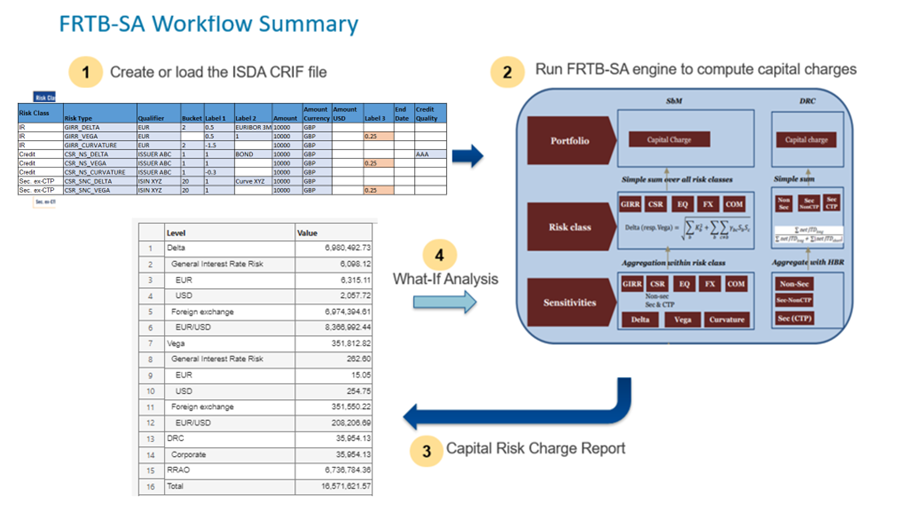

- Sensitivity‑Based Measure (SBM): Risk‑class sensitivities (delta, vega, curvature) aggregated under prescribed risk weights and correlations.

- Default Risk Charge (DRC): Jump‑to‑default capital for credit‑sensitive instruments.

- Residual Risk Add‑On (RRAO): A targeted add‑on for residual risks not captured by SBM or DRC—for example, exotic features or payoff discontinuities.

SA runs at the trading‑desk level, requires no prior regulatory approval, and remains mandatory even for IMA‑approved desks (as a fallback and for the output floor). Many firms adopt SA first to cover every desk consistently and then layer IMA where it’s justified by the portfolio and data.

Example SA workflow in MATLAB: ingest ISDA CRIF, compute capital, and run what‑if analysis.

Internal models: opportunity – with daily discipline

Where justified, IMA can represent portfolio risk more realistically capturing non‑linearities and desk‑specific dynamics. The trade‑off is an intensive validation loop – computed daily and evaluated over rolling windows:

- Profit & Loss Attribution (PLA) (sometimes “PLAT”) checks alignment between the risk‑theoretical P&L from the model and the desk’s hypothetical P&L from front‑office pricing.

- Backtesting compares forecast risk to realized outcomes; exceptions accumulate over a window and drive zone outcomes.

- Risk Factor Eligibility Test (RFET) demonstrates modellability using observed “real price” data over a defined observation period.

Desks that fail the applicable thresholds revert to SA until they requalify. This validation cadence demands robust data ingestion, reproducible audit trails, and elastic compute.

Example dashboard: A daily IMA validation loop in MATLAB, with desk‑level views for PLA/PLAT, backtesting, and modellability.

Why a scriptable risk engine matters

Regardless of methodology, you need a consistent, auditable way to turn data → capital → validation → reporting every day. A scriptable risk engine—capable of ingesting ISDA CRIF and product‑control data, applying jurisdiction‑specific rules, and emitting reproducible artifacts—lets you:

- Run SA and IMA side‑by‑side for coverage, benchmarking, and floors.

- Automate daily ingestion → calculation → tests → rolling‑window evaluation → reporting.

- Build validation dashboards for PLA, backtesting, and RFET.

- Scale across clusters or cloud for heavy revaluations and scenario sweeps.

- Centralize controls, data definitions, and governance—reducing duplication and audit effort.

- Support complex modeling utilities (e.g., non‑linear risk, what‑if analysis, stress exploration) that inform trading and hedging decisions.

Turning compliance into insight

With a scalable, scriptable platform, FRTB becomes more than a compliance project:

- Capital attribution becomes clearer at the desk level.

- Desks make better hedging and pricing decisions, informed by transparent drivers.

- Daily operations gain resilience through automation and repeatability.

Regulatory implementation timelines differ by region, but firms that invest now in robust SA engines and flexible IMA prototypes will adapt faster as rules evolve.

Learn more

- Read the white paper: Mastering Market Risk Capital (FRTB)

- Explore: FRTB with MATLAB

- Category:

- Back Testing,

- Risk Management

Comments

To leave a comment, please click here to sign in to your MathWorks Account or create a new one.