Accelerating Asset Management with ModelOps: From Model Building to Monitoring

Asset management quants face complex data environments, tight timelines, and the constant pressure to translate models into actionable decisions. Model development is no longer the bottleneck—debugging, deployment, and ongoing governance now define the pace and success of portfolio innovation.

In a recent webinar, Marshall Alphonso and David Barnes, both Application Engineers at MathWorks, showcased how a ModelOps workflow—built with MATLAB and integrated tools—can help investment teams respond faster to shifting market dynamics, manage risk more effectively, and ensure model transparency across all stages of development.

Watch a recording of the webinar here.

Moving Beyond Ad Hoc Model Building

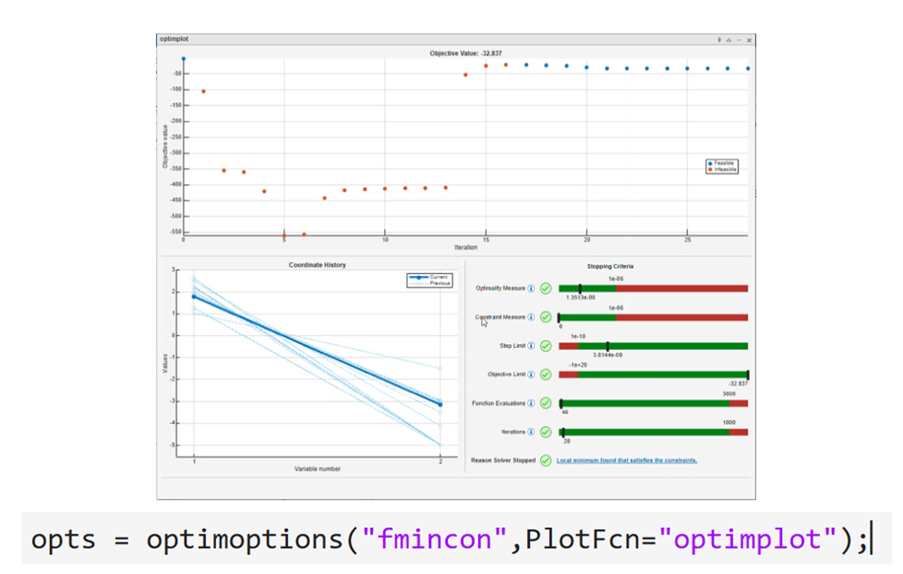

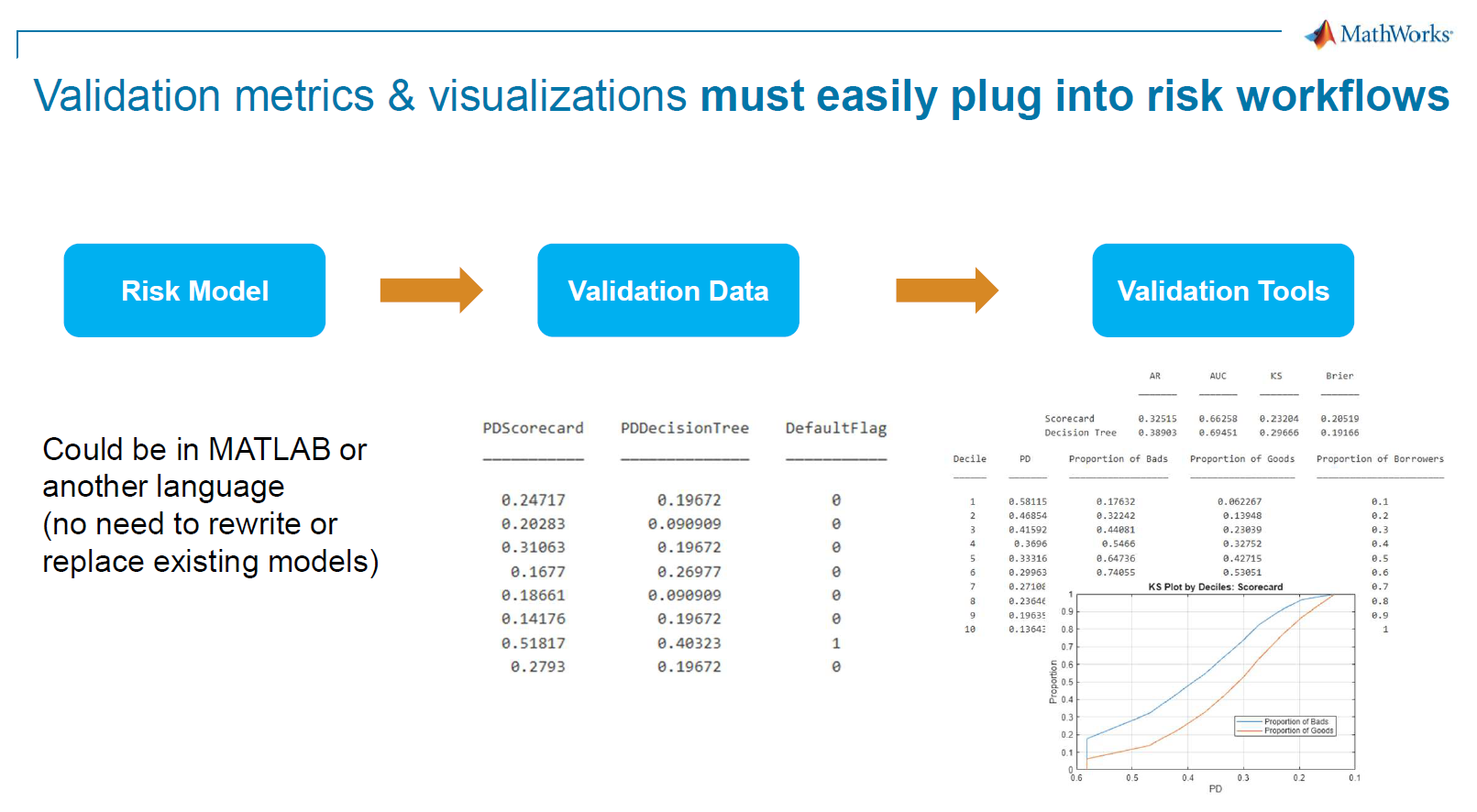

Too often, modeling workflows stall due to fragmented development, limited diagnostics, and inefficient collaboration with stakeholders. The webinar demonstrated how prebuilt apps and diagnostic tools accelerate model formulation, streamline portfolio construction, and simplify model validation.

MATLAB app with asset allocation inputs and optimized portfolio output.

One example focused on adjusting portfolio risk exposure in response to rising allocations to private equity. Using a combination of interactive dashboards and live scripts, Marshall demonstrated how to analyze correlations, detect latent risk factors, and iterate quickly based on stakeholder input.

Diagnosing Failures Before They Happen

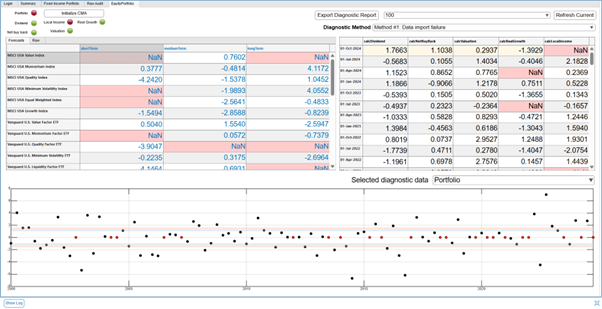

Market regimes evolve, data quality shifts, and optimization routines fail. The ability to detect, trace, and respond to these issues in real time is critical. MathWorks tools enable portfolio quants to identify concept drift, backtrack through feeder models, and isolate breakdowns at the component level.

Diagnostic dashboard for factor model health and forecast aggregation

David highlighted how one asset manager used this setup to reduce model troubleshooting time by 90%. Instead of relying on static spreadsheets or opaque processes, the team received real-time alerts when model assumptions failed—enabling faster corrective action and better transparency with leadership.

Deploying and Monitoring at Scale

Deploying models across enterprise systems remains a challenge for many firms. But with integrated CI/CD pipelines and support for cloud platforms, MATLAB allows quants to manage deployment and monitoring within a unified environment.

The webinar demonstrated how models built in MATLAB can be automatically deployed as RESTful services, tracked for performance, and re-run on demand—all without manual IT setup. This setup supports both model transparency and reproducibility.

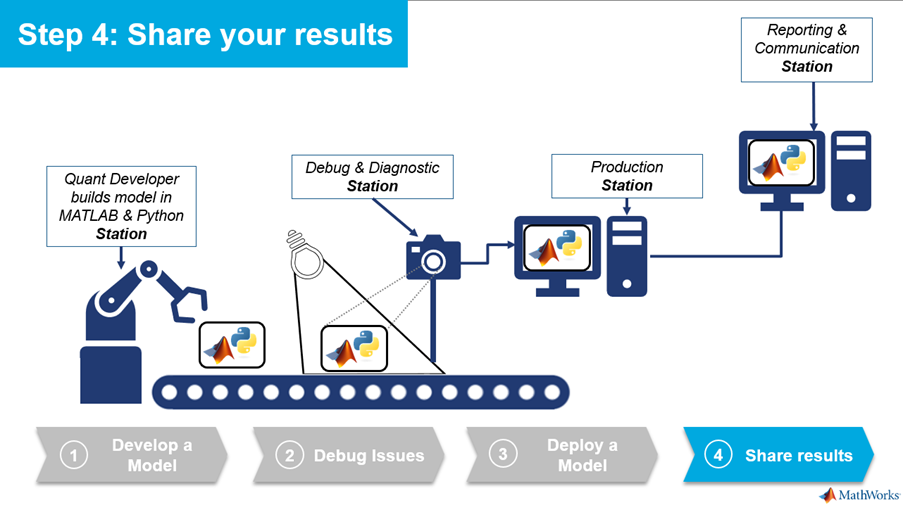

Creating a Collaborative Modeling Environment

The final step in the ModelOps workflow is communication. With live scripts and customizable dashboards, quants can share results that are traceable, reproducible, and tailored for stakeholder review. As Marshall noted, early involvement from risk managers and senior leaders helps ensure model trust and faster decision-making.

The final step – sharing your results.

Ready to Try ModelOps?

MathWorks offers guided workshops—no IT setup required—that help asset managers experience a ModelOps workflow in their own environment. Whether integrating diagnostics, optimizing deployment pipelines, or tracking model health, these tools are designed to reduce friction and improve agility across investment teams.

For more information or to set up a session, contact Marshall Alphonso or David Barnes at MathWorks.

- Category:

- Asset Management,

- ModelOps

Comments

To leave a comment, please click here to sign in to your MathWorks Account or create a new one.