The following blog was written by Sara Galante, Senior Finance Application Engineer at Mathworks.

The code used to develop this example can be found on GitHub here: Managing Asset Allocation with… 더 읽어보기 >>

The following blog was written by Sara Galante, Senior Finance Application Engineer at Mathworks.

The code used to develop this example can be found on GitHub here: Managing Asset Allocation with… 더 읽어보기 >>

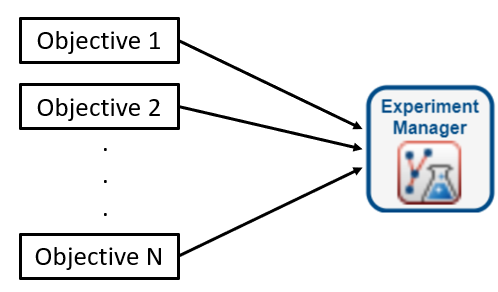

The following blog was written by Leslie Zhang, a Northeastern graduate who recently joined MathWorks Engineering Development program. This post aims to highlight the collaboration opportunities… 더 읽어보기 >>

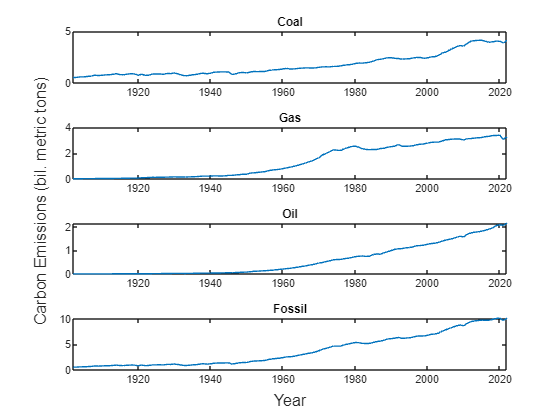

The following post is from Hang Qian, Software Developer on the Econometrics Toolbox Team.

Global carbon emissions have increased dramatically since 1901. However, the annual growth rates were… 더 읽어보기 >>

It’s my pleasure to give everyone a sneak peek into the upcoming MathWorks Finance 2023 conference, which will be held virtually over 2 days on October 11 and 12.

You will get a chance to hear how… 더 읽어보기 >>

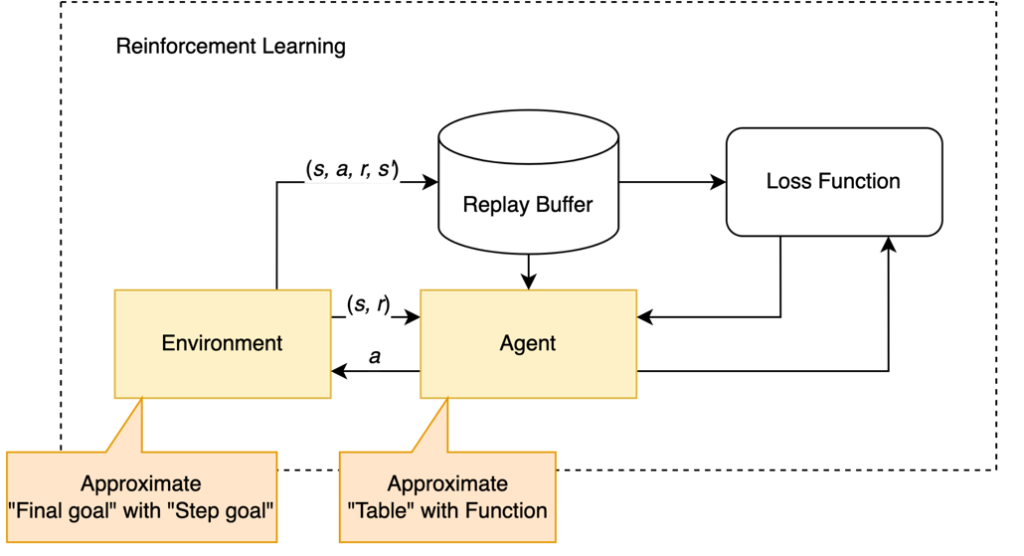

The following post is from Ian Chie, Bowen Fang, Botao Zhang and Yichen Yao from Columbia University.

Inspiration

Let’s say you want to invest and make money. Your goal is to maximize your… 더 읽어보기 >>

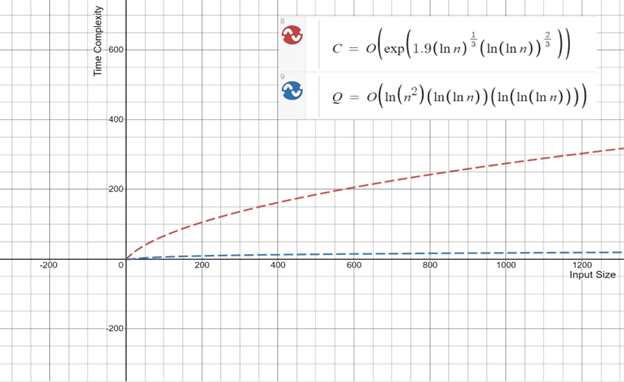

The following post is from Sofia Ma, Senior Engineer for Finance

Quantum computing is a cutting-edge field of study that harnesses the principles of quantum mechanics to perform complex computations… 더 읽어보기 >>

Hi Everyone,

I would like to welcome you to our new blog on Quantitative Finance. To kick things off, I’d like to give an overview of the main areas that we’ve been working on here at MathWorks in… 더 읽어보기 >>